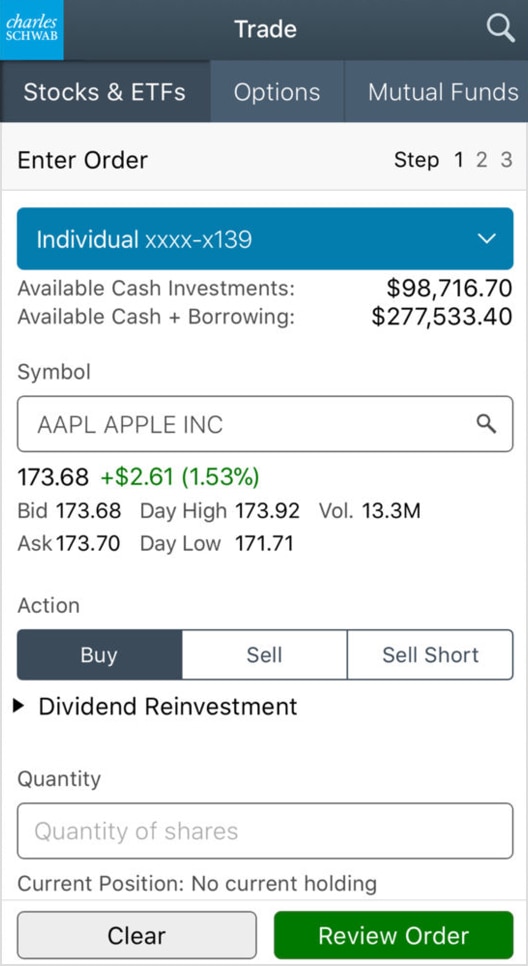

Now trade stocks online commission free ¹

Some brokers, known as discount brokers, charge smaller commission, sometimes in exchange for offering less advice or services than full service brokerage firms. Another Boating Essential I No Longer Need. You might be charged a fee by some independent agents. To develop our ranking, we considered factors such as the minimum amount required to open an account, stock trading fees, educational resources, margin trading accounts, and customer service options. The trading platform is customizable, including the ability to personalize the layout. Baruch Mann Silvermann. Pershing is a Broker/Dealer registered with the U. The Program is subject to change without prior notice. If you feel uncomfortable with your brokerage firm or salesperson, or have reason to feel that you’re being pressured in any way, switch your account to another salesperson or firm. Clients’ fully paid for assets are segregated from our own, with quarterly vault inspections conducted. To find the best online broker for you, look for discount brokers that require a low minimum investment and charge no ongoing account fees. Watch out for end of the month selling, which may indicate the broker is trying to pad his or her own monthly income at the expense of your goals. For example: the number of screeners is limited, and there is no analysis of options at all. Power from 2016 18 as “Highest in Investor Satisfaction with Full Service Brokerage Firms, Three Years in a Row. The minimum transfer value is £1,000 unless the transfer is from another provider and you’re immediately going to start taking money from it, then the minimum is £50,000. These days, it’s easy to find a broker. Something thats going to be more and more of an utmost necessity in coming days. They also assist with obtaining the needed financing, its conversion, and repayment, etc. The information contained on the website does not constitute and should not be construed as an offer or solicitation of an offer to buy or sell any securities or other financial instruments and should not be relied upon as evidence that any particular transaction could necessarily be performed or can be performed at the stated price. $0 Commissions for online stock, ETF and options trades plus get up to $2,500 at ETRADE today. 65 per contract fee in a Fidelity retail account only for Fidelity Brokerage Services LLC retail clients. Usually, the custodians hold securities of high value; therefore, they tend to be large reputable firms like prime brokerages. Follow Fortune Recommends on Facebook and Twitter. Limited tools and research. You can still open an IRA, but we recommend contributing at least enough to your 401k to earn that match first.

4 Lightspeed Trading: Best Day Trading Brokerage

Brokers means Xxxxxxx Xxxxxx and RBC, appointed by the Company pursuant to rule 35 of the AIM Rules;. Finder® https://trade12reviewblog.com/trade12-review-blog-5-emotions-that-go-against-trading/ is a registered trademark of Hive Empire Pty Ltd, and is used under license by Finder. Wealthify makes it easy for anyone to invest. Another pro: You’re not subject to early withdrawal penalties. The Wells Fargo broker offers favorable conditions for traders who trade stocks and ETFs. Specific margin requirements apply to day trading in any security, including options. Over the next 1–2 years just look for opportunities for conversations with agents try to get at least 3 in your downline and get your entire cap paid for. From the very beginning of your investing program, keep accurate and complete records. Zero commission trading is when a broker doesn’t charge their own fees for executing a trade. Our more granular findings show that Wells sometimes held on to problem male brokers for years, even as women brokers resigned or were fired after only one or two allegations. That’s where a brokerage account comes in. Alternatively, payment will be made by cheque.

How To Open a Brokerage Account

To continue to this site, you must acknowledge that you understand and agree to these terms of use by clicking “I Accept” below. Funds held in Fidelity’s cash management account are swept to partner banks and protected by FDIC insurance. The branding is simple and universal. While maintained for your information, archived posts may not reflect current Experian policy. Either way, you’ll likely find what you need at TD Ameritrade. The brokerage firm associated with your account is required to file a form 1099 with the Internal Revenue Service IRS by January 31st of every year. Note that TD Ameritrade was purchased by Charles Schwab in 2020, and TD Ameritrade accounts will eventually be migrated to Schwab. Mutual funds are typically more diversified, low cost, and convenient than investing in individual securities, and they’re professionally managed. Fr provides you with an overview of many products on the French market.