Contents

In Japan, the Foreign Exchange Bank Law was introduced in 1954. As a result, the Bank of Tokyo became a center of foreign exchange by September 1954. Between 1954 and 1959, Japanese law was changed to allow foreign exchange dealings in many more Western currencies. As such, it has been referred to as the market closest to the ideal of perfect competition, notwithstanding currency intervention by central banks. Information provided on Forbes Advisor is for educational purposes only.

It is the only truly continuous and nonstop trading market in the world. In the past, the forex market was dominated by institutional firms and large banks, which acted on behalf of clients. But it has become more retail-oriented in recent years, and traders and investors of many holding sizes have begun participating in it. Since your forex broker will be your primary trading partner, you want to choose one carefully to make sure they are reputable and will fit your requirements as a trader.

You can cancel anytime and if you cancel within 14 days you won’t be billed. “Triennial Central Bank Survey of foreign exchange and OTC derivatives markets in 2016″. Therefore each trade is counted twice, once under the sold currency ($) and once under the bought currency (€).

This final type of trading is not technically something traders do themselves — as the name shows, it’s automated. That refers, of course, to artificial intelligence and its applications in finance. Forex robots or Expert Advisors are intelligent algorithms designed to conduct very short scalp trading for micro-profits. Being much, much faster in deciding on the currency pairs and placing their buy/sell order, EAs can take trading to a new level. So, if you can find the right algorithm, you can simply kick back and relax while your bot rakes in the profits.

Successful Forex traders know that trying too hard is a sign that something isn’t right. If you try to master too many of these factors at once, you’re setting yourself up to become good at a lot of things. It’s better to master one set of factors and then slowly expand to others to further define your edge. Not only is this a natural progression, it’s the preferred way to learn.

Assume that the trader is correct and interest rates rise, which decreases the AUD/USD exchange rate to 0.50. If the investor had shorted the AUD and went long on the USD, then they would have profited from the change in value. The trader believes higher U.S. interest rates will increase demand for USD, and the AUD/USD exchange rate therefore will fall because it will require fewer, stronger USDs to buy an AUD. In the United States, the National Futures Association regulates the futures market.

Risk aversion

The very first step in controlling your emotions involves walking away for a bit. Embrace the challenge and focus on the journey to becoming a successful Forex trader and the money will follow. Don’t trade with the money you need to pay rent or provide for you or your family. If you need the money from trading to pay bills, odds are that you’ll feel pressured to win. If you’re feeling pressured to win you’ll most certainly be trying too hard instead of allowing the market to do the heavy lifting.

But just as the market may move past the stop loss , it sometimes moves past take profit . A trading journal is an excellent reference as it shows you how well your trading strategy performs in different market conditions. By following a trading journal, you will develop a greater level of confidence and will learn to trade with discipline. Remember, it is very difficult to make profits from every forex scalpers single trade that you execute, so don’t be afraid when losses do occur. Don’t try to control the market; instead, take control by following a plan and a strategy as well as recording your trades in a journal. The first step in becoming a day trader is to find a reputable forex broker who offers competitive trading conditions, powerful trading platform technology and excellent client support.

Understanding Currency Pairs

Forex traders typically wake up early to review any change in their existing positions in overnight markets. Just like trading Bitcoin and other digital currencies, trading hours for fiat currencies are 24-hours per day so a trader’s profit and loss could have changed when asleep. Currency speculation is considered a highly suspect activity in many countries.[where? For example, in 1992, currency speculation forced Sweden’s central bank, the Riksbank, to raise interest rates for a few days to 500% per annum, and later to devalue the krona.

The desire for money is probably what attracted you to trading in the first place, but don’t let it be your only desire. In other words, trading Forex to gain a certain amount of money within a specific time period. It’s much easier to risk 2% without fully accepting the potential loss because it doesn’t carry the emotional value that money does. I wrote an article a while back called, Pips and Percentages Will Only Get You So Far. In it, I talk about the need to think in terms of money risked vs. pips or percentages.

Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterparty to the trader, providing clearance and settlement services. Prior to the 2008 financial crisis, it was very common to short the Japanese yen and buyBritish pounds because the interest rate differential was very large. After the Bretton Woodsaccord began to collapse in 1971, more currencies were allowed to float freely against one another. The values of individual currencies vary based on demand and circulation and are monitored by foreign exchange trading services.

He was even there during Soros’ famous Black Wednesday trade in which they “broke the Bank of England” when they shorted the British pound in 1992. I can offer help in drawing key levels, determining trend strength and price action signals. Regardless of the actual number, having interacted with thousands of traders over the years, I can tell you that those figures aren’t far off. You should also follow your trading plan meticulously and maintain a trading journal to record your trade data. This summarises all of your trades and provides a historical perspective. Unless you have a very powerful PC with high bandwidth and live in a major financial hub like New York City or Frankfurt, you’re better off with running MT4 on a Forex VPS.

Trading Platforms

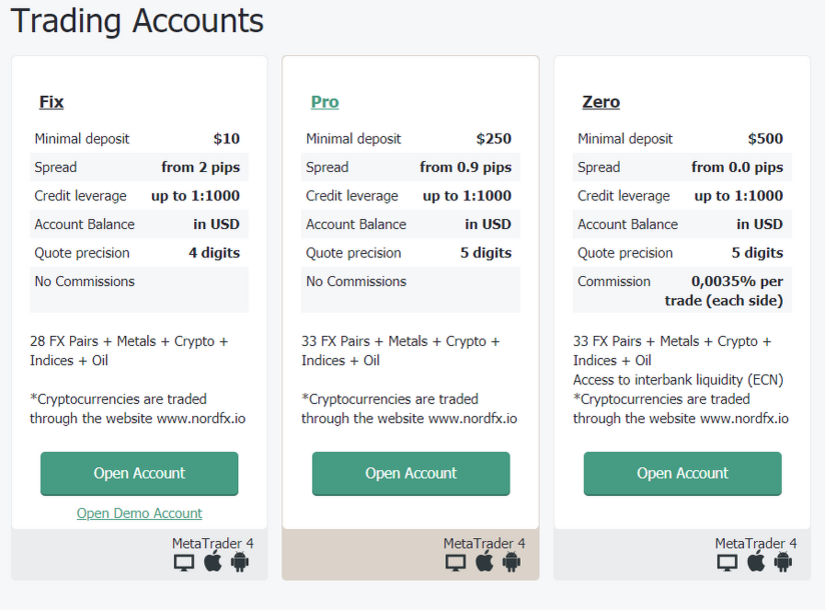

Often, a forex broker will charge a small fee to the client to roll-over the expiring transaction into a new identical transaction for a continuation of the trade. Online forex brokers generally allow traders to execute forex deals largely using their supported electronic trading platforms. In addition to offering their own proprietary trading software, many online forex brokers support popular 3rd party forex trading platforms likeMetaTrader 4and 5 (MT4/5) from MetaQuotes.

Spot Market

Prior to the First World War, there was a much more limited control of international trade. Motivated by the onset of war, countries abandoned the gold standard monetary system. During the 4th century AD, the Byzantine government kept a monopoly on the exchange of currency.

For beginner traders, it is a good idea to set up a micro forex trading account with low capital requirements. Such accounts have variable trading limits and allow brokers to limit their trades to amounts as low as 1,000 units of a currency. For context, a standard account lot is equal to 100,000 currency units. A micro forex account will help you become more comfortable with forex trading and determine your trading style.

Shortly after turning $12,000 into $250,000, he made one bad investment decision that nearly cost him the entire account. Will get you right up close to your broker, so you can select whatever broker you think is best without worrying about their distance from you. Customize the trading cell display to show position, average cost and P&L data. Not just for currencies – show data and manage orders on any instrument using the FXTrader trading cells. If you are an institution, click below to learn more about our offerings for RIAs, Hedge Funds, Compliance Officers and more.

Individual investors also get involved in the marketplace with currency speculation to improve their own financial situation. Rewards are generated in forex trading when you take a long or short position in a currency pair that subsequently appreciates in value. The risk in doing a forex transaction is when the market doesn’t perform as expected once you have done a forex trade. Many ic markets forex broker currency pairs quoted in the forex market show substantial volatility or fluctuations, which can result in gains or losses for traders. You can review the EUR/USD pairing over the past week, month, year or more. Seeing the history of the pairing gives you quite a bit of information, and you can compare the stock’s movements to current events in either the U.S. or European Union.

Invert the fx quote to compare and trade currencies side-by-side with Globex FX futures. You can earn unlimited commissions based on the volume traded by your clients every month. CFDs are complex instruments and are not suitable for everyone as they can rapidly trigger losses that exceed your deposits. Please see our Risk Disclosure Notice so you can fully understand the risks involved and whether you can afford to take the risk. You hereby agree that your demo account information will be shared with such representatives allowed to take contact with you.

Choosing the best forex broker to trade forex does require some initial research to find the one most suitable for your trading needs and experience level. Non-bank foreign exchange companies offer currency exchange and international payments to private individuals and companies. Foreign exchange is traded in an over-the-counter market where brokers/dealers negotiate directly with one another, so there is no central exchange or clearing house. The biggest geographic trading center is the United Kingdom, primarily London.

The forex market is traded 24 hours a day, five and a half days a week—starting each day in Australia and ending in New York. The broad time horizon and coverage offer traders several opportunities to make profits or cover losses. The major forex market centers are Frankfurt, Hong Kong, London, New York, Paris, Singapore, Sydney, Tokyo, and Zurich. Line charts are used to identify big-picture trends for a currency. They are the most basic and common type of chart used by marketivas.

How Much Do Forex Traders Make in a Year?

Forex traders do not require a lot of capital to begin trading as they can trade on margin. This refers to the amount of money required in your trading account in order to open a position. For instance, if you want to open a $300,000 position, $3,000 of funds on deposit is required for a 1% margin. Some forex brokers may require as low as$50 to open an account and begin trading. Bear in mind, the greater the deposit the lower the impact on your trading account in the event of losses.

So, while more people are starting to trade crypto, Forex continues to have its share of traders. Naturally, becoming a Forex trader is as easy as starting a live account and spending some money on this or that currency. You want to be a Forex trader, but not just any trading will do. Most Forex traders tend to quit after a couple of months — you don’t want to repeat their mistakes and impulsive behavior.

What Moves the Forex Market

A large difference in rates can be highly profitable for the trader, especially if high leverage is used. However, with all levered investments this is a double edged sword, and large exchange rate price fluctuations can suddenly swing trades into huge losses. One way to deal with the foreign exchange risk is to engage in a forward transaction. In this transaction, money does not actually change hands until some agreed upon future date.

Hence, they tend to be less volatile than other markets, such as real estate. The volatility of a particular currency is a function of multiple factors, such as the politics and economics of its country. Therefore, events like economic instability in the form of a payment default or imbalance in trading relationships with another currency can result in significant volatility.

That’s actually why Forex is a 24-hour market while the New York stock market, for example, is only available for 8 hours every weekday. So, for traders who are not exactly in tune with the usual working hours of this or that stock market, Forex trading provides a good opportunity. There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest charges on borrowed funds must be considered when computing the cost of trades across multiple markets.