A major flipping part, to acquire a house, calls for careful believe, economic readiness, and-above all-the proper investment alternatives. Without the advice off a professional home loan arranger, the procedure of acquiring a home financing are advanced and you can taxing inside North park. Investigating the financial obligation, the advantages they give you, and how it enable a flawless domestic-to buy processes, this web site talks about this new critical updates a hillcrest mortgage arranger performs. Understanding the core away from a property financing plan assists possible homebuyers so you’re able to confidently discuss the fresh difficulty off house financing.

Inside San diego, where real estate industry was competitive and you may brilliant, the knowledge away from property mortgage arrange will get important. Its thorough attention to multiple mortgage situations, rates of interest, and you will software strategies guarantees you to definitely customers get customized recommendations fit for the finances.

A home loan app are overwhelming whilst means mindful validation procedure and most records

Doing an intensive financial studies of your debtor is among the most area of the commitments regarding home financing arrange. For example examining the fresh new customer’s income, credit rating, really works record, and most recent personal debt load. Expertise these economic factors assists the house Mortgage lender North park elite to indicate mortgage choice that fit new borrower’s problem. That it tailored strategy claims your debtor doesn’t overindulge financially and you may enhances the likelihood of mortgage greet.

Away from traditional funds in order to authorities-recognized fund particularly FHA and Va finance, the latest Hillcrest Home financing Choice landscapes gifts good rainbow out of money choice. Through providing the latest borrower the quintessential standard alternatives, a skilled home loan arranger streamlines this difficulty. They break out this new subtleties of any mortgage type, plus eligibility standards, interest rates, and you can terms of pay. That it comprehensive recommendations facilitate new debtor to choose financing you to most closely fits their demands and you can long-title economic expectations in the form of told choices.

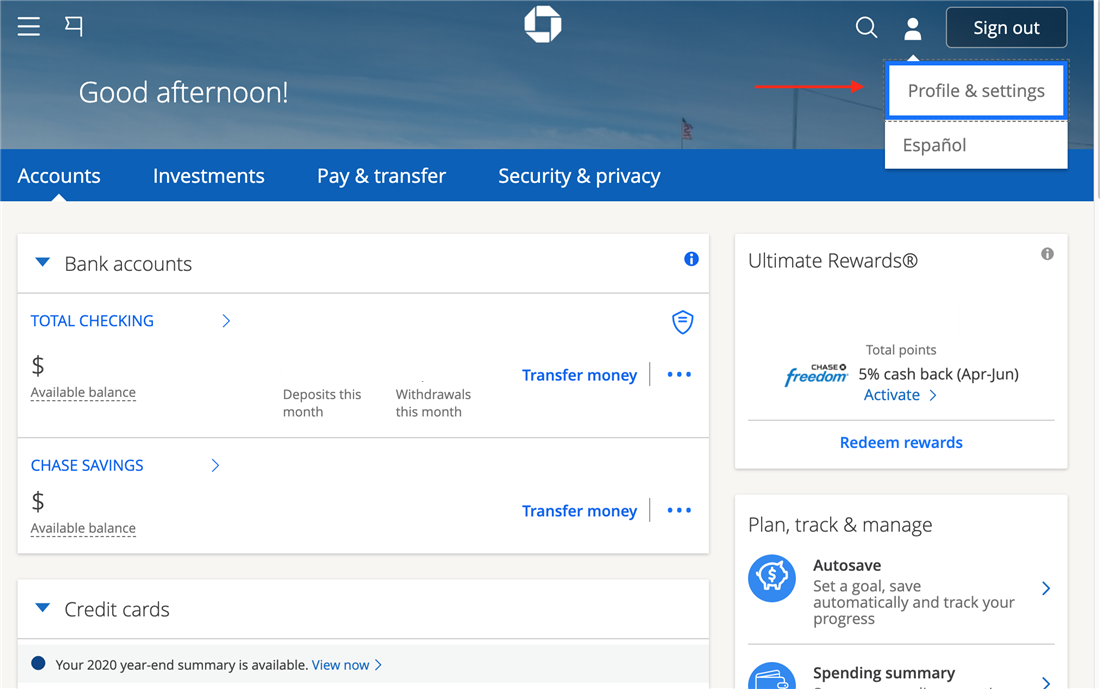

Simplifying this action mainly relies on a north park family mortgage arranger. They help users safely over applications, secure the required files, and you may send these to the lending company. The training pledges that paperwork is finished and you can conformable which have bank criteria, so quickening the fresh new recognition process.

Another important character regarding a home loan program is actually discussing finest financing requirements. Its globe knowledge and relationships with various lenders assist them to in order to negotiate on the part of the fresh debtor to track down realistic interest rates and versatile payback episodes. That it settling ability can cause highest coupons along the financing existence, therefore to make homeownership alot more low-priced to the buyers.

A mortgage arranger suits motives exterior just loan approval. They address any queries the fresh debtor could have and supply ongoing help all throughout the house-to shop for techniques. That it proceeded recommendations pledges that the debtor stays sure and you will educated within their choice. The home Loan Specialist North park is obtainable to include constant support when it concerns regards to the loan otherwise closing processes.

The genuine estate industry out-of North park possess particular unique services and you may inclinations. Local experience with home financing plan contributes the best value. He or she is conversant with the local property beliefs, construction ics off areas. It regional education enables them to render designed guidance fit for this criteria and preferences of the borrower. Its established ties to help you nearby real estate professionals and lenders along with make it possible to ease the purchase procedure.

By providing strategic the recommendations and achievable alternatives, home financing arranger can help you defeat these barriers

Let’s remark specific victory tales showing the worth of an excellent mortgage arranger. Consider an initial-time homebuyer whose absolutely nothing credit score overwhelms the mortgage app processes. They increased their credit standing, discussed loan selection by using a mortgage arranger, and finally acquired an enthusiastic FHA financing with good conditions. Another such as for instance is a seasoned San diego buyer out-of good household. Leverage their ability discover a no-deposit mortgage, your house financing arranger assisted all of them from Va loan process, therefore providing homeownership.

You’ll find difficulties in the process to obtain home financing. Typical obstacles is high credit prices, rigid borrowing from the bank conditions, and difficult files methods. It help customers make certain the documents is actually direct and you may done, talk about almost every other credit choices, and you may raise the credit ratings. Its proactive approach greatly raises the possibility of mortgage greeting.

Other than private transactions, financial organizers dictate neighborhood more fundamentally. Encouragement out-of homeownership helps ensure your neighborhood savings try secure and you can develops. One of the personal and economic benefits related to homeownership try significantly more civic wedding, finest educational show, and cohesiveness regarding organizations. To make such professionals available to so much more San diego citizens depends vitally into the paydayloancolorado.net/sierra-ridge/ a loyal home loan arranger.

A significant very first stage in your house-buying techniques are selecting the compatible home loan contract. Prospective individuals is give thought to aspects along with feel, character, and you may customer recommendations. An accomplished North park household loan professional that have a reputation profitable transactions and pleased customers is likely likely to send earliest-rate therapy. Also, extremely important characteristics regarding a mortgage arranger try open communication and you will a customer-centric emotions.