Push someone more funds more another aspect because, oh, really I am attending make this upgraded fridge, or I’m probably make this admiration X, Y, Z topic. Yep. And so all that is completed ahead of time. Exactly what a smart move. Which is quite slick. Now once you manage a broad contractor, are they available to that? They form of know mm-hmm. such as for instance, This is the way we services. This can be [] what is browsing take to accomplish that, and you’ve got so you can form of enjoy within sandbox in the event the your desire to really works that it away. Otherwise maybe you have got a builder who’s including, No, that is just not exactly how we mode? Or just how, how does one, Perhaps you have had people such as, pressures by doing this?

Alex McKinley: Zero, not even because I believe that builders very delight in one to he has some body on the https://paydayloanalabama.com/sardis-city/ front detailing the newest numbers and you may detailing something up in advance since they are anticipated to, he’s got her deals they’ve the homeowners signed with them. That sort of set.

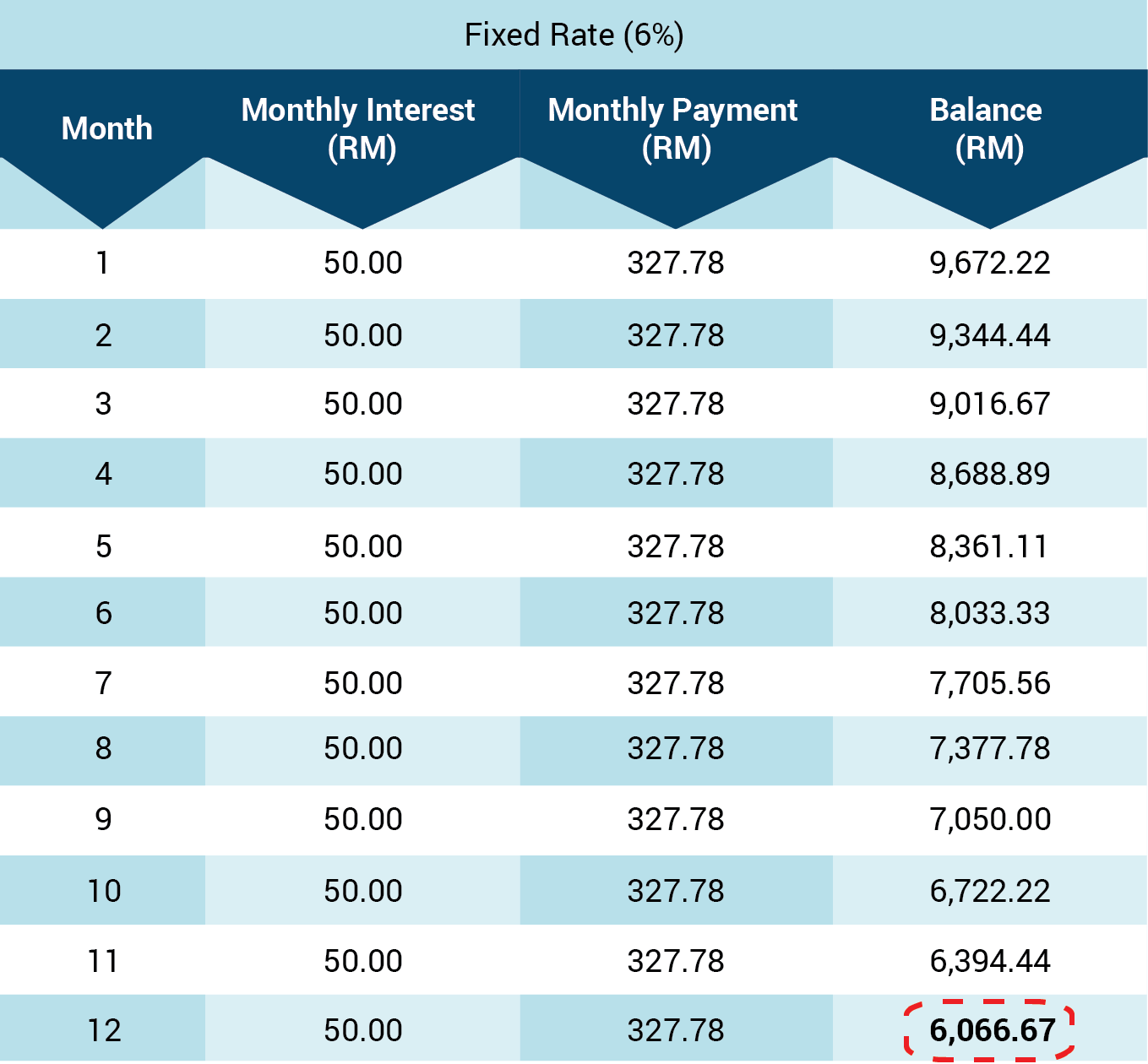

It’s, its kind of like a, I love to brand of examine it so you can a beneficial, a line of credit, but [] its fixed so you shell out on which you employ while you never use the whole point, it does not roll over towards the long lasting financing

Their their, their map, proper? For the entire design and you can one allowances, the majority of these fashion accessories, they will certainly simply might plug within the several for, you realize, products. Let me reveal your finances for device, let’s strive to sit significantly less than you to definitely, best? Because yeah, it’s quite common to take some overage. However, most of the contractors appreciate how we handle you to because the we will get the funds and then we shall add a good, a backup likewise just like the our company is starting this enough time [] enough that we be aware that there can be particular overruns on rates.

So we added a small amount of a boundary. Usually its an additional 5% or more ‘s the average more than exactly what our company is currently financing them on the budget. And this method if something really does are located in a little bit more expensive, I have some a reserve over right here so you’re able to capture that and, and apply they for this extra cost.

However others situation that takes place sometimes is mainly because we create our brings on line things, can you imagine the foundation was available in at under was questioned and you may. And you were left with 3000 a lot more bucks that you failed to play with, then i sort of move you to definitely down seriously to another range item only to provides another buffer particular subsequently.

Lindsay Sutherland: Today, your said earlier speaking of kind of all in all structure financing and perhaps some preliminary expenses someone may have currently acquired on their own with the just before it confronted with your

But at the bottom, if you have anything that it did wound-up staying away from on the construction financing, they will not spend.

Mm-hmm. . So that types of facilitate prevent those individuals, those people will set you back which can possibly go all over, more. The good news is builders contractors enjoy we do it that method cuz it enjoys some thing structured and then it is form of with another individual. Enabling the, the people learn what exactly is expected into the enterprise and how some thing are done.

And it’s not only them you are sure that, asking really of them. So we all-kind out of collaborate. It truly does work. Yeah.

Occasionally an area mortgage. Do you guys provide on residential property as well as, otherwise, I guess, let me ask you it also. What if individuals is thinking about it, they’re convinced the following year regarding carrying out, they do not have homes yet, [] manage now become a great time to-arrive aside? How does one procedure work for new, into the buyer?