If you were dreaming of purchasing a house but presumed you to your income otherwise credit history perform disqualify your, a government-recognized loan is worthy of exploring. Government-backed mortgage loans is specialized money that have insurance from a certain department of one’s federal government. These money will often have down borrowing from the bank, loans, and earnings standards, that’s good for all the way down-income customers. Remove your credit rating and you will determine your debt-to-money proportion for additional information on and therefore loan models you’ll be able to be eligible for.

Before applying for a mortgage, it is very important remember that you’ve got the finances to support the mortgage payments

- Average household rates for the Maryland: $404,703

- Minimal deposit in the Maryland: 0% to three.5%

If you think one to now could be a great time to find property, the next thing is to try to get a home loan. Just like the procedure for taking a home loan might seem overwhelming, the truth is that most lenders gets you experience an equivalent simple steps, such as the following the.

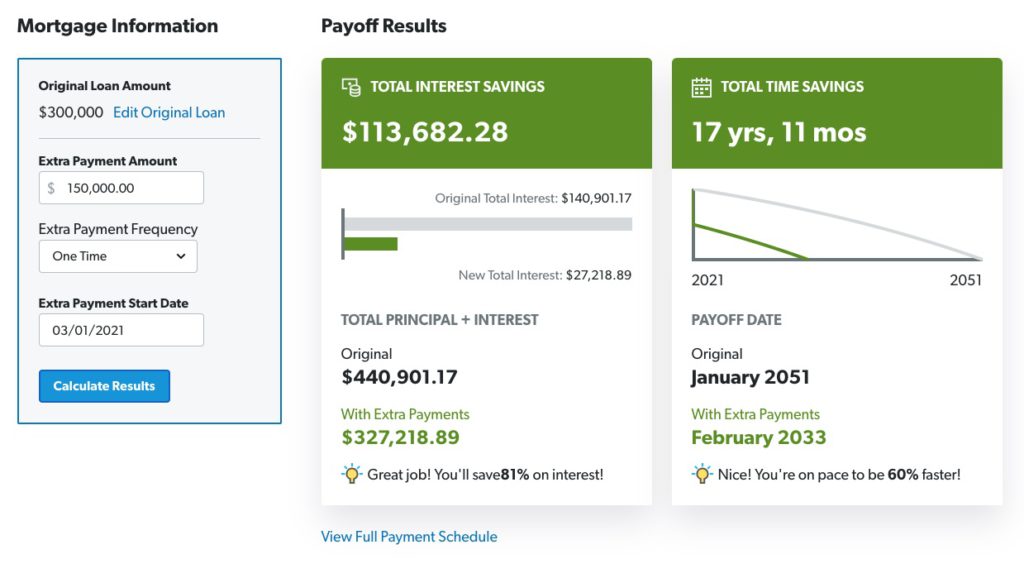

Make use of the home loan calculator linked above setting a rough finances for your house research and you may examine you to budget to a few land towards the an on-line real estate databases. When it turns out your finances can loans the full cost of homeownership and you may an interest rate, you can move to preapproval.

An excellent pre-acceptance letter try a young contract to finance your residence purchase from a loan provider. Providing pre-accepted getting an interest rate is an essential step prior to purchasing a house as it also offers an upper restrict precisely how much money you could acquire. This offers an even more concrete budget installment loans online in West Virginia for your property lookup.

Today can be an enjoyable experience to use to one or maybe more out of s to possess very first-big date customers. Statewide down-payment assistance is readily available through the ent (DHCD), which operates brand new s open to assist with last costs courtesy this choice include the following.

Before you apply getting an interest rate, it’s important to remember that there is the finances to support your own mortgage repayments

- Fold 5000: The latest Bend 5000 system has the benefit of an effective $5,000 loan to own advance payment and you may settlement costs, with a no per cent interest rate which is owed whenever you pay out of the loan otherwise refinance.

- Fold 3%: Just like the Fold 5000, this new Fold 3% program offers up to 3% of cost of your house into the an effective deferred next mortgage due in the event the latest loan ends.

Note that you should get your mortgage loan as a consequence of a DHCD-approved lender to be eligible for down-payment direction.

Including informing manufacturers that you’re in a position to buy an effective assets, good pre-acceptance page along with tells realtors that you are intent on buying a property. Just after form a more good budget having financing approval, apply to an agent close by to determine your circumstances and commence our home search. When you are word-of-mouth recommendations will likely be a trusting source for agent ratings, NAF Residential property ,* an affiliate marketer regarding NAF, may also be helpful hook you having qualified experts in your area.

Immediately after meeting with your broker, tell them in the everything desire to escape your household browse. Free no details when it comes to exactly how many bed rooms, design, construction possibilities, amenities, and other services you prefer on your new house. The greater number of details their real estate agent needs to work with, the greater amount of they’re able to improve your hunt. Remember to share a specific funds and you can let your agent know if you have monetary self-reliance with regards to price.

When you come across a house that you want to purchase, the next phase is to submit a deal letter. The deal page was an offer to order a home, published to the modern proprietor of the property. Your offer page will include extremely important information on the newest business, including: