The way to get good piggyback loan

If you get a great piggyback financing, you’re making an application for several separate mortgages at a time. Certain lenders let you score each other mortgages in identical place. But more often, borrowers find yourself with their first-mortgage in one lender, in addition to their second home loan away from a special.

Type of piggyback financing

There are two main ways a beneficial piggyback financing are organized. The first – an loan, and therefore we simply checked out – is considered the most popular. But financing is additionally an option. With this particular version, the primary mortgage money simply 75% of the home price in lieu of 80 percent.

- 75% of your own purchase price are funded by the no. 1 financial

- 15% originates from another home loan, tend to good HELOC

- 10% nevertheless originates from the brand new customer’s cash downpayment

Particular home buyers utilize the design to eliminate getting good jumbo financial or perhaps to finance a property that needs a top off commission (particularly a residential property).

How piggybacking is also stop jumbo loans

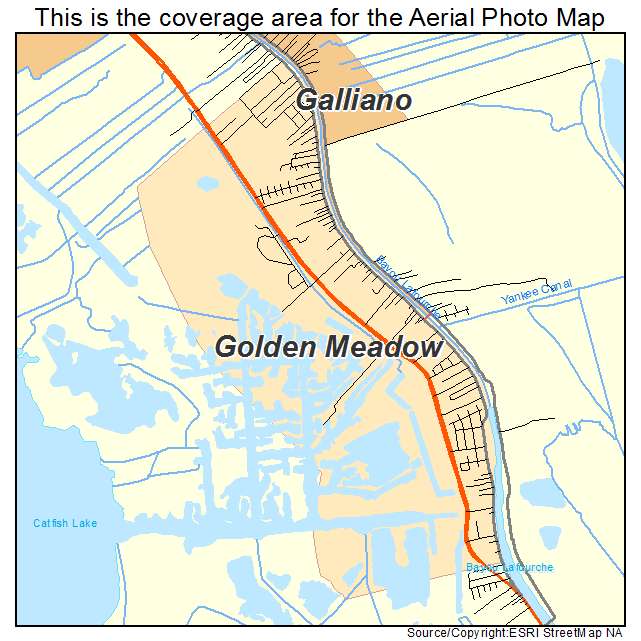

Of the meaning, a compliant loan pursue guidelines put because of the Fannie mae and you can Freddie Mac. Compliant money need to be inside local loan limitations put because of the such enterprises on a yearly basis. Such as for instance, when you look at the 2025, new conforming mortgage limitation for most of your You.S. are $ .

Home financing one to exceeds so it restrict mortgage dimensions wouldn’t be eligible for a conforming mortgage. The customer would need a great jumbo loan alternatively. Jumbo loans often be more expensive and regularly possess more strict qualifying rules.

In some instances, to make a much bigger down payment normally push that loan back within this compliant financing constraints. Without having the newest initial cash getting a bigger off commission, an effective piggyback home loan may be the respond to.

Because of it analogy, we are going to state you might be to buy a beneficial $850,000 household and you’ve got saved up $85,000 having a down payment. You might you would like an excellent $765,000 financial to finance the rest of the household speed. That is more than this new conforming financing restriction for almost all of your own U.S., meaning this condition would want a good jumbo loan.

Today let us was the fresh new piggyback loan, alternatively. This plan do include a different sort of 5% – $42,500 – on the downpayment, lowering your priount in order to $637,five-hundred. Which is nearly $10,000 lower than the fresh compliant financing limitation having 2022.

piggyback to possess condos

Additionally, it is well-known to see the latest always get a good condominium. It is because mortgage cost to have condos was higher if the loan-to-worth ratio (LTV) of the first mortgage is higher than 75 percent.

To stop investing high rates, condo buyers could possibly get restrict the basic lien dimensions to 75% of your own condo’s well worth. They then build an effective 10% downpayment and the left fifteen% is covered by the an excellent HELOC.

Piggyback fund getting financial think

Piggyback loans give an alternative line of advantage over one-loan programs: They may be sophisticated equipment getting economic shelter and you can thought. That is because regarding the way the piggyback loan is prepared. The second loan for the a beneficial piggyback is normally a home security credit line (HELOC), which gives your a handy borrowing from the bank provider you can try this out while the a citizen.

Such as for instance, extremely HELOCs features variable rates of interest. Meaning your price and commission number changes out of month to day, depending on industry criteria. When the Provided brings up its benchount would raise, as well.

An excellent $40,000 HELOC during the six% appeal would want $268 a month; an excellent $forty,000 HELOC at the 8% interest do charges regarding $335 a month.

The good news is one HELOC rates trend much lower than just other funds that have variable rates. Very they might be nevertheless a less expensive supply of credit than just handmade cards otherwise signature loans, such as.

Refinancing an excellent piggyback home loan

You might wonder: Easily get an excellent piggyback mortgage, will i ever before manage to re-finance it? The solution try sure – but refinancing with the next home loan is a bit more challenging.