Go out Maximum getting Prepayment Punishment-3 years

A good prepayment punishment is just anticipate when you look at the very first 3 years pursuing the financing are consummated. Immediately following 36 months, a prepayment punishment actually greeting. (twelve C.F.Roentgen. (g) (2024).)

Financing is actually “consummated” when the borrower becomes contractually compelled with the financing. Dependent on condition law, this can be if loan data files was closed or when the lending company commits to extend borrowing to the debtor, such.

Just how Lenders Determine Prepayment Penalties

To the first two years following the loan try consummated, the new punishment cannot be greater than 2% of one’s amount of this new outstanding mortgage equilibrium. To the third year, new penalty are capped on 1% of your own an excellent loan balance.

Bank Cedar Bluff loans Must Bring that loan Choice Versus a beneficial Prepayment Penalty

Simultaneously, in the event the a loan provider even offers a loan including a beneficial prepayment punishment, the lender should provide an option loan that doesn’t were a prepayment penalty. In this manner, the financial institution must have a good faith faith that user almost certainly qualifies towards the choice mortgage.

Bank Must provide Your With advice On the Prepayment Punishment

Beneath the CFPB guidelines, if the financing enjoys an excellent prepayment punishment, the fresh servicer otherwise financial need tend to be information regarding this new penalty:

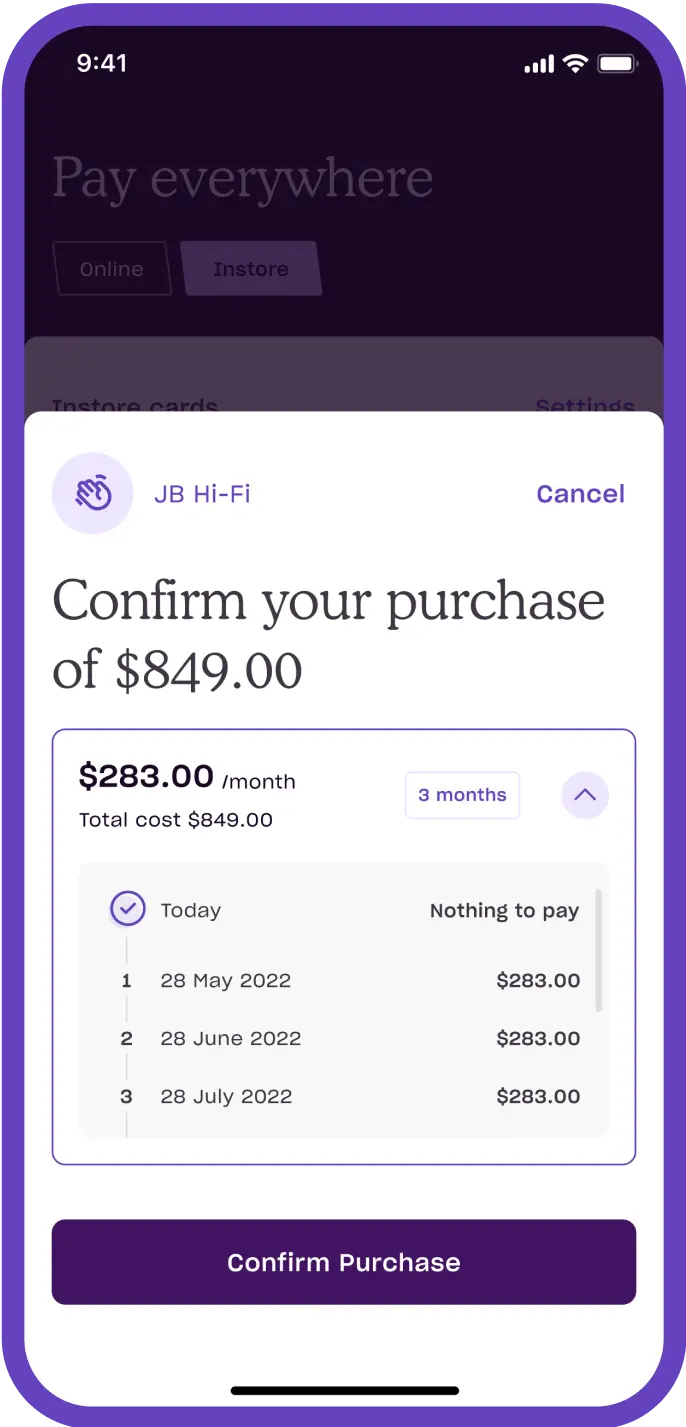

- in your periodic battery charging report (that’s constantly sent month-to-month) (12 C.F.Roentgen. (2024)) or

- in the voucher publication (which is a text provided by the brand new servicer otherwise bank with a web page each battery charging cycle to have a-flat several months, commonly 12 months, in which here debtor rips regarding a typical page otherwise part of the webpage and you may efficiency it into mortgage servicer with each commission), and you can

- into the interest adjustment observes. (more…)