In fact, the newest Social Security Government has not one fee via direct deposit could have been forgotten since the 1976, when beneficiaries have been first given the possibility to get head deposit. For many who’lso are worried about securing your banking advice on the web, you’re questioning if or not cellular cheque deposit is secure to explore. The fresh short response is you to definitely mobile cheque put is just as safer as your almost every other on the internet and mobile financial functions. That’s since the cellular cheque put feature inside software fundamentally offers a person-amicable sense, for even lower-tech people. If you’re able to works the digital camera in your cell phone or pill and you understand how to obtain an application, then you may play with mobile cheque deposit.

Betting on the mobile phone – Lux internet casino

If you would like the fresh Irs to deposit their refund for the simply one to membership, use the direct deposit line in your income tax form. Don’t have a available to to find their routing and you may account count? A navigation amount describes the region of your financial’s branch where you exposed your account and most banking companies listing the navigation number on the other sites. Your bank account amount usually can be found by the signing into the on line bank account otherwise by the calling your bank branch.

Find the best On line Banking institutions Away from 2024

Whenever we usually do not accept a certain form of cheque, the fresh app would not accept the new cheque and you’ll be led when deciding to take the newest cheque to help you a branch Lux internet casino otherwise Post-office in which appropriate. The newest Mobile Put a Cheque feature is a new capability introduced to the our very own mobile software because the an initial offering. We are consistently working to boost its functionalities considering structured future mobile releases and you can customer comments gotten. If the there are one complications with the new cheque you’ve paid in, we’ll get in touch with your using the latest postal target your’ve considering us. You can check the fresh target i keep to you personally on the Character part of their application.

Spend from the Cellular Casino

With the services out of Boku to have handling your digital gambling enterprise harmony is fast, easy and safe. There are numerous benefits of making repayments through your cell phone. Using an e-bag is also inconvenient because needs performing a profile and you may uploading money before you could make any pick.

It’s a safe and you will safer strategy, along with most devices requiring facial otherwise fingerprint detection to have access, it has become better than carrying around a physical borrowing credit. When you’re lender transmits is actually queen to have secure places, cellular borrowing from the bank gaming is actually the best. The complete character from paying thru cellular phone debts makes it a good bulletproof strategy. You can show the new commission via Text messages, so that deposit isn’t supposed anyplace unless of course the smartphone are taken.

Notate so it’s “to possess cellular put simply” in person using your signature, and look the brand new “cellular deposit” field if the relevant. Log on to help you on the internet banking in your cellular phone or make use of the application and pick put from your own financial dash. Being able to find an automatic teller machine towards you – and higher yet, a zero-fee Automatic teller machine – is yet another probably one of the most of use popular features of cellular financial. The brand new put might be paid off later, at the end of the brand new week, with your typical cellular phone statement. I produce the fresh confirmation matter in the small emails to the bottom of your own top of one’s take a look at, following waiting a few weeks to ensure there have been zero issues for the deposit.

In the financial industry, this type of electronic purchases try referred to as remote put bring. They’lso are canned myself through the bank’s digital platform, as well as the investigation you send out is actually covered by encoding. As well as, instead of inside-person take a look at dumps, you can get a direct electronic verification or bill just after making an excellent mobile take a look at deposit. To submit a cellular consider put, you initially have to signal the back of it. This is the same as promoting a newspaper check that your put during the a part otherwise through an automatic teller machine. On the back of your own take a look at the underside their trademark, you’ll need produce what “to own cellular put simply” or specific version, according to your bank or credit connection’s criteria.

And then make a great £5 put by cell phone costs from the online casinos, you only discover the “Spend by Cellular phone” solution during the cashier, enter the mobile amount, and prove the new payment via Texts. The new £5 put was put in your next cellular telephone bill or deducted from the prepaid service balance. If you want not to make use of the pay by the cellular phone deposit method, there are several alternative options available. They’re age-wallets such PayPal, Neteller, and you can Skrill, which provide a safe and you can smoother means to fix manage your gambling enterprise fund instead of revealing your bank account otherwise card info.

A few of the newer programs these days run in video function and you will breeze the image for your requirements whenever criteria is proper. Lender away from The united states, You.S. Bank and you will Wells Fargo are among the larger financial institutions utilizing the brand-new technology. The fresh software prompts you if you ought to, say, relocate to the best, rating closer to the new consider otherwise explore more light. Our people never spend us to ensure beneficial reviews of the products or services. Some inspections can take prolonged to processes, so we may need to keep certain or all put to own a tiny lengthened. We’re going to tell you whenever we need keep a deposit and include information regarding when to assume your money.

Deals ranging from enrolled users normally occur in minutes. If your person is already enrolled having Zelle, the money goes in to the savings account, typically within a few minutes. If they aren’t enrolled but really, they’re going to rating a notification describing how to receive the money only and you can quickly. Inside the 2007, USAA turned the original bank to offer remote deposit take broadly so you can users thru house-founded readers. It matter is not implied as the a referral, provide or solicitation on the pick or sales of every shelter or funding means.

The money is then extra nearly instantly to your Jammy Monkey account and your exchange might possibly be affirmed having an Sms. After you do an AdvancePay membership, you’re-creating a great prepaid service collect calling solution enabling an inmate to-name their contact number using deposited money. Sure, you may use Ally eCheck Put to cover an alternative Certificate from Deposit (CD) . For those who have numerous monitors, you ought to complete all of them from the 7 p.m.

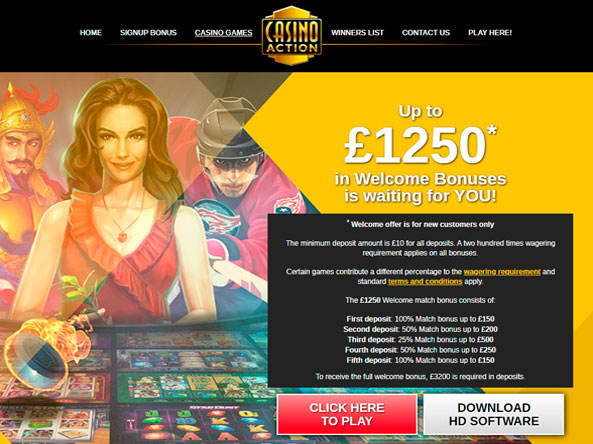

Read the current analysis in the Casino Wings observe which our company is suggesting in the industry today. To make it less difficult, we offer you here having an introduction to the finest come across from pay by the mobile casinos in the united kingdom. These gambling enterprises are usually powered by Boku Gambling establishment British, a banking strategy considering mobile statement even though while we’ll detail afterwards, there are alternatives.

With more than a decade of expertise, Allison makes a name for by herself because the a great syndicated financial writer. Her articles are composed within the leading books, including Banking institutions.com, Bankrate, The brand new Wall surface Path Diary, MSN Money, and you may Investopedia. Whenever she’s not busy doing content, Allison trip nationwide, sharing the woman education and you can experience in financial literacy and you can entrepreneurship due to entertaining workshops and you can software. She in addition to performs because the an official Monetary Education Instructor (CFEI) intent on enabling folks from the walks of life get to monetary independence and you can achievements. Please note you to additional cellular phone enterprises handle collect calls differently and you may there can be extra charges, will cost you, restrictions and you may restrictions out of gather phone calls together with your supplier.

Certain continual expenses, for example book or utilities, might be paid via lead deposit. Generally, banking users often create this type of direct put having their lender via the business’s “statement pay” choice. This is often the only method to set up such a great head put, because it can be difficult otherwise to get the lead financial guidance for the continual costs.

It may take a short time to your purchase becoming finalized, and this “might be a surprise for young adults that are familiar with economic transactions experiencing quickly,” Maize states. Luckily, financial programs is actually smart and can help you make sure a good picture quality. “Pursue Private Buyer” is the brand name to have a banking and you will financing device and you may solution offering, requiring an excellent Chase Individual Consumer Checking℠ account.

- The simplest way to find out if debt establishment also provides cellular cheque put would be to cheque the banking software otherwise call the lending company otherwise borrowing union.

- It’s one of several easiest tips there’s at the an internet casino, along with transactions getting encrypted and you will completely protected.

- One of several brand-new procedures is actually Boku that allows digital players to cope with their money thru the cell phones.

- When you are indeed there’s a lot to such as regarding the mobile consider put, there are a few prospective disadvantages.

- Therefore, if you wish to gamble slots spend by the mobile phone costs, you definitely obtained’t be distressed.

Simultaneously, state gamblers and you will funds-centered players can build higher usage of that it services, because allows these to follow a budget and you can perhaps not go overboard using their investing. The put consult have undergone, nevertheless’s however a smart idea to hold on to the view for a few months. Money One suggests remaining the brand new register a safe, safe lay if you don’t understand the full amount placed in your account. Following the deposit are verified, you can properly ruin the newest consider.

That’s just what remote deposit capture allows—the newest replacing away from an electronic form of their seek out an excellent paper you to. Chase’s web site and you will/or mobile conditions, confidentiality and security formula don’t connect with the site or app you happen to be going to see. Excite comment their words, confidentiality and you may protection principles observe the way they apply at you.

Find the bank account for which you wanted the brand new check’s fund so you can end up being deposited. Under your signature, make “For mobile put merely” otherwise “To possess deposit here at [Their Lender Identity].” Particular monitors provides a printed checkbox to own mobile deposits. However, this won’t alter the need generate these statement.

Once you have made their put, you will get a contact verification you to definitely we’ve gotten their put and try running it. You possibly can make as numerous dumps as you would like, but you’ll find everyday and monthly constraints to the buck count you can deposit. Whenever you go to enter into your consider, the brand new app will reveal the absolute most you could potentially deposit. If you wish to deposit a cost that’s more the new limitation, check out one of the branches or ATMs.