The term, otherwise period of time you must pay back a personal loan, is typically in the a couple of in order to 5 years. It is far quicker than the cost identity having a home loan, which will be multiple many years enough time. Thus you’ll have less time to pay off your consumer loan, which could make your monthly payments high.

Rates of interest

Unsecured unsecured loans may have highest interest levels than simply secured personal loans since there is zero equity toward bank to seize in the event the your standard on the financing. Because lender are taking on significantly more chance by the lending to your having an unsecured unsecured loan, they fundamentally costs way more inside the appeal.

You will have probably in order to meet a minimum earnings and you may borrowing rating to be acknowledged getting a personal bank loan. Certain lenders would provide a consumer loan to possess lower income , but such financing could have a high interest rate.

Unsecured loans can be used for whichever mission, and additionally financing a cellular family or even as funds to have house improvement . It self-reliance means to purchase a mobile house with a personal financing will make feel for your requirements. not, whether your are formulated house qualifies since real-estate – definition it is into a foundation, doesn’t have tires, and also you individual the new home significantly less than they – you are best off together with other financing alternatives.

Whether your mobile house match the phrase real estate, you might make an application for home financing with some conventional mortgage software, instance Federal national mortgage association otherwise Freddie Mac, otherwise agency-backed home loan apps, such as those throughout the Federal Homes Government (FHA), the You.S. Agencies away from Veterans Affairs, or even the You.S. Company from Farming.

Another type of investment solution you can search for a mobile home is good chattel loan. This is exactly a type of individual assets mortgage that can easily be used in moveable possessions, such as for instance if cellular house is based in a manufactured home society while book the home this new cellular is on. The mortgage doesn’t come with the fresh new homes, and https://paydayloanalabama.com/myrtlewood/ so the closure techniques is a lot easier and less costly than it is with a normal real estate loan. not, chattel funds are typically for a small amount of money than simply mortgages try, and they have smaller fees terms and conditions. Which means the eye cost on the chattel money are usually large, that’ll cause high monthly financing costs.

Bringing a personal bank loan for a mobile Household

If you have felt like a personal loan ‘s the right selection for your mobile domestic buy, there are many steps in the procedure. Some tips about what to-do.

1pare Lenders

When looking for an unsecured loan to have a cellular house, you need to compare lenders observe exactly what prices and you will words they might give. You can explore choices off financial institutions and you will borrowing unions, including those people from on line loan providers. When choosing an on-line financial, avoid people warning flag that laws the lender may well not become legitimate. Watch out for things such as impractical claims, discrepancies regarding financing fine print, and you can asks for initial application fees.

dos. Pertain On line

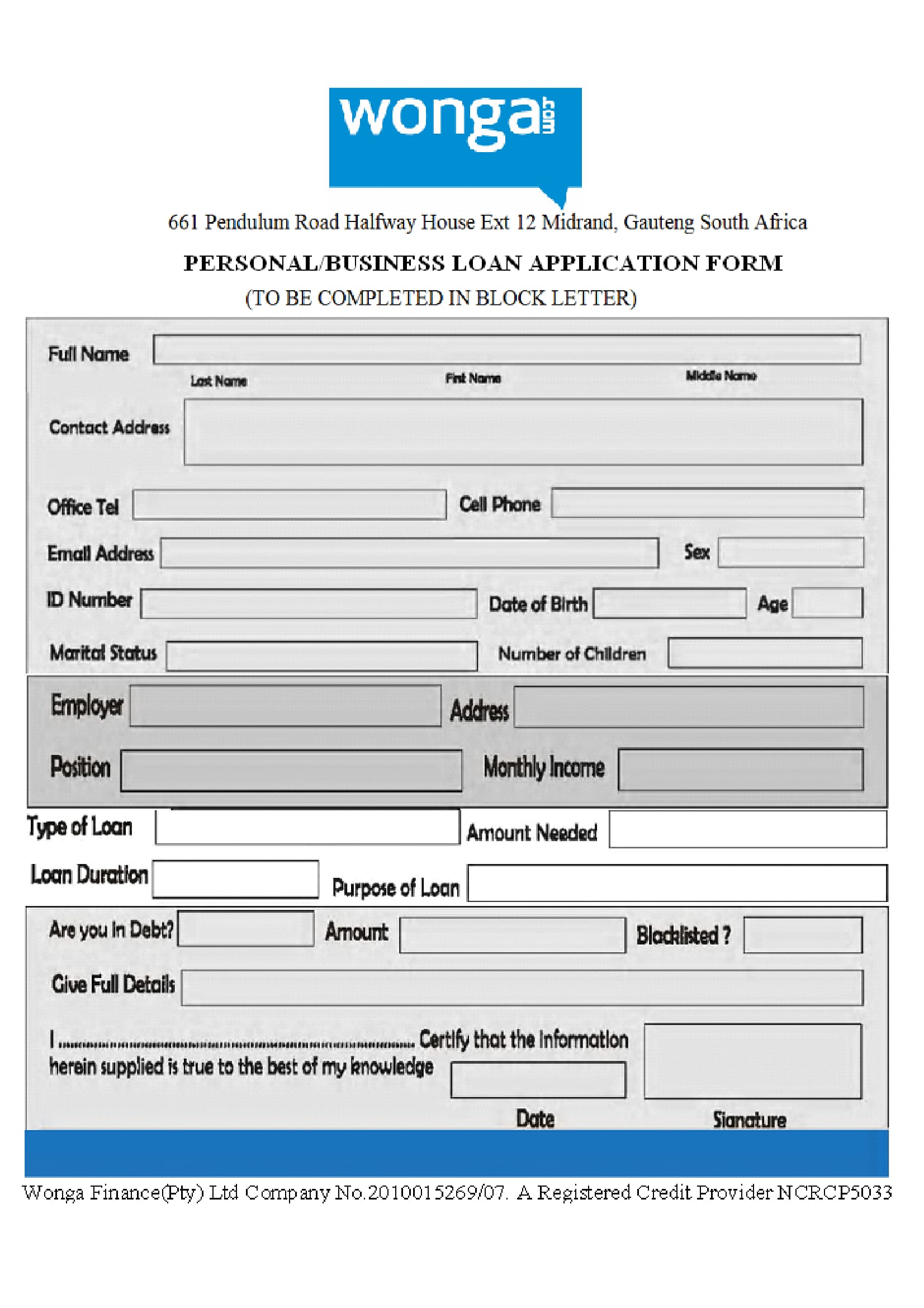

When you come across a lender, you can make an application for a personal bank loan . Implementing on the internet is usually the fastest and you may simplest way. As you grow been, know that there are certain consumer loan standards you will have to see. For-instance, you’re going to have to submit an application and gives several records, like proof of money, a job, and you will term. Gather such data beforehand and now have them able.

step three. Located Funds

Shortly after you are acknowledged for a personal loan, you will get the cash inside the a lump sum, usually contained in this several days. Some loan providers even promote same-go out funding. You’ll then repay the money you borrowed which have desire throughout the years into the monthly payments.