A money-aside refinance on the FHA should be a terrific way to influence security of your home. However, do you really meet the requirements? Here’s everything you need to discover

- What is a profit-away re-finance FHA?

- Ought i rating an earnings-out re-finance to the a keen FHA mortgage?

- Is actually a profit-away re-finance FHA worth every penny?

- Cash-aside refinance FHA: closure opinion

Since the a homeowner, more worthwhile asset you individual is probably your house. For those who have reduced a significant amount of your mortgage, you’ll also likely be able to obtain extra cash to possess big costs. Such will are major domestic renovations or college tuition for the children.

This is when a keen FHA bucks-out re-finance will come in. FHA signifies Federal Housing Administration, and is the easiest way to influence the fresh new collateral in your domestic.

On this page, we are going to look at exactly what a finances-aside refinance FHA are, the way it operates, and you can who is eligible. Listed here is all you need to find out about an FHA cash-aside re-finance.

What’s a finances-out refinance FHA?

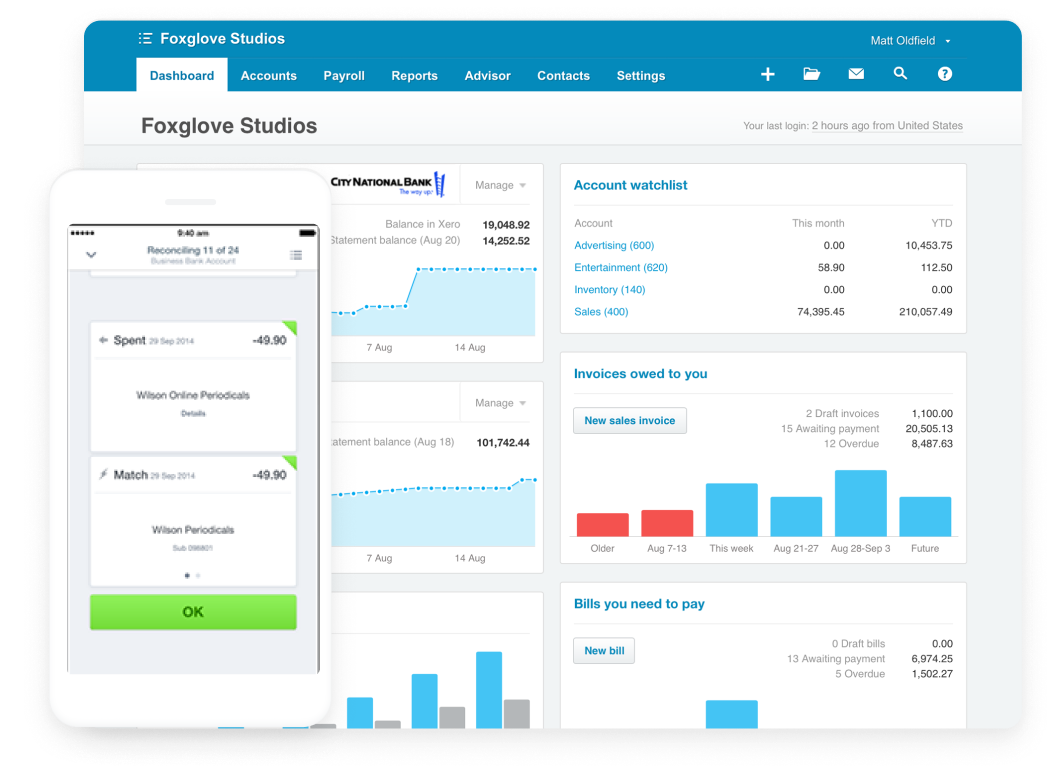

![]()

An FHA dollars-out refinance occurs when you have to pay of your mortgage with yet another, larger home loan that is insured from the Government Casing Government or FHA.

The degree of the greater financing is based on the amount off equity you’ve got collected of your home. What’s more, it comes with the amount you still owe on your present home loan as well as how far more funds you need.

Cash-away re-finance FHA: how it works

You can use an FHA dollars-aside refinance for those who have collected household security, and therefore the house is really worth over you borrowed to your the mortgage.

When doing a cash-aside refinance, you take aside an alternative mortgage for more currency than you are obligated to pay in your dated financial, which is next paid off. The borrowed funds bank up coming gives you the real difference just like the a swelling share and can be used a la mode.

A keen FHA dollars-away refinance performs similarly, except the fresh new finance is actually covered because of the FHA. Because it’s government-backed, you’re entitled to down costs than you may get with other refinancing choice. You could potentially actually meet the requirements if the credit score try below best.

Cash-out refinance FHA: example

In order to an idea of exactly how a keen FHA dollars-away re-finance functions, why don’t we glance at an illustration. Say you borrowed $200,000 in your newest home loan and you may home assessment enjoys computed the home is worthy of $eight hundred,000. For those who had an FHA bucks-away refinance, you might borrow around 80% of your house’s value, otherwise $320,000.

For those who called for $100,000 for home improvements, might undo a special home loan software techniques, as if you performed for the very first mortgage, having a good $three hundred,000 mortgage alternatively. If the recognized, $2 hundred,000 of this manage go toward paying your early in the day mortgage. And you payday loan Mount Bullion will instead, you’ll begin making money on the the fresh $300,000 mortgage every month.

As with any sort of refinancing, you should think about settlement costs. This is simply a special factor to consider should you decide to move men and women expenditures into your new home mortgage.

Cash-out re-finance FHA: criteria

New FHA features minimum standards for FHA funds. These minimum conditions include FHA cash-aside refinance. Yet not, FHA loan providers are also able to place her standards in inclusion for the FHA conditions.

Credit score

FHA funds try common getting enabling credit scores as little as five-hundred. To own FHA cash-away refinance, but not, you will want a higher credit history for the greatest offer. Though some mortgage brokers tend to agree a credit rating since lowest because the 620, the lowest rates was reserved getting consumers that have a cards get with a minimum of 740. Its smart to change your credit score just before making an application for a keen FHA dollars-out refinance.