Once you’ve registered your cryptocurrency losses, you’ll find a way to carry them ahead indefinitely. However, you may have a four 12 months time restrict to register your capital losses. After this era, you’ll find a way to now not register your losses and use them to offset gains. If you haven’t been reporting your gains or losses in previous years, you may get every thing in order by filing an amended self-assessment tax return. Typically, you’ll acknowledge income when you earn cryptocurrencies. Although it’s attainable to calculate your crypto taxes manually, a crypto tax calculator like Recap saves time and will increase accuracy.

Cryptotaxcalculator is tailor-made to the needs of accountants and bookkeepers, and it contains support for tax regulations within the United Kingdom and worldwide. This makes it perfect for accountants and anyone who desires to maintain tabs on their crypto holdings. If you’ve inherited crypto from someone’s property, you’ll owe inheritance tax on sums above £325,000. A £500,000 inheritance could be taxed £70,000 (40% of £175,000).

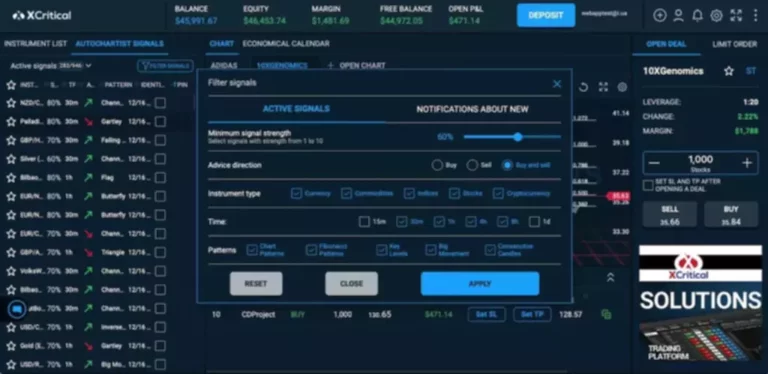

This is essential, as some crypto tax software program suppliers don’t assist DeFi platforms and exchanges. Not only is CoinTracker perfect for automating capital gains but also crypto income taxes. This includes staking, mining, airdrops, mints, margin interest, and forks. What’s extra, the computational process takes minutes, irrespective of how many transactions are being assessed. Most crypto tax software may help you full the necessary tax varieties at the end of the tax year. In the UK, you’ll have to report crypto revenue in a self-assessment tax return (SA100) and document any capital features or losses using a capital gains summary (SA108).

Not sponsored or something however came throughout CryptoTaxCalculator.io @CryptoTaxHQ. Such a straightforward way to track and record your crypto taxes mechanically. Made monitoring my Binance spot/futures trades + Uniswap transactions a complete lot less daunting. Least Tax First Out is an unique algorithm that optimises your crypto taxes by using the asset lot with the best value foundation whenever you set off a disposal occasion. As a result, claiming capital losses can considerably scale back your tax legal responsibility, and even bring your total taxable features beneath the tax-free allowance quantity of £12,600. In the United Kingdom, capital losses can be utilized to offset your capital features for the yr.

How Is Cryptocurrency Staking Taxed?

This is because software program suppliers provide optimization tools, similar to tax loss harvesting. Top providers also help numerous cost-basis strategies, similar to FIFO and LIFO. There’s a free plan however this is restricted to an total tax summary.

It may even prevent a headache at the end of the tax 12 months when you should fill in your tax return. That’s as a result of you’ll be in a position to mechanically fill within the required HMRC forms. You also can relaxation easy that you’re complying with all the complicated HMRC guidelines on crypto tax. These complicated guidelines were invented to cease crypto buyers from manipulating their features by selling and rebuying crypto assets to create a man-made loss.

Uk Tax Guide

Do your individual analysis before investing in any crypto platform and only make investments the quantity you probably can afford to lose. Many nations are partially tax-free in phrases of crypto. Germany, for instance, doesn’t charge tax on income from crypto sales if you hold your crypto for over a yr. Yes, there are four crypto transactions that aren’t subject to Income Tax or Capital Gains Tax. So if you sell, swap or send it, HMRC sees it as a taxable occasion. If the value of your crypto keeps rising, you might additionally need to pay Capital Gains Tax on the income when you exchange it for £GBP.

This shouldn’t take more than 30 minutes, though it’s normally a lot sooner. The software merely cross-references the coin with spot buying and selling prices when the orders are positioned. For $99 or $199, you’ll get 1,000 and 3,000 transactions, respectively. If you’re happy to fill out IRS Form 8949 yourself, the free plan supports unlimited transactions. CoinLedger additionally supports localized tax reporting for other international locations, together with the UK, South Africa, Australia, Canada, India, and Japan.

Its distinctive tax report templates embrace these which are made specifically for UK taxpayers and embrace information about your income and allowable deductions. Despite being a relatively new form of asset with an evolving regulatory landscape, it’s essential to emphasize that cryptocurrencies are not exempt from taxation within the UK. Finder.com is an independent comparability platform and knowledge service that goals to provide you with the instruments you have to make higher selections.

Discover Out Which Transactions Are Classed As Profit By Hmrc

However, the method rapidly becomes cumbersome if you’re an active crypto dealer. This is also the case should you take a dollar-cost averaging strategy. As an accounting firm that specialises in crypto taxes, Crypto Tax Calculator is a device we couldn’t stay with out. Being able to combination client’s transactions throughout all exchanges and blockchains into one data feed brings incredible efficiencies to the crypto tax compliance course of.

As of October 31, 2022, the crypto tax software system had filed 11,000 tax filings and had 250 million USD in money beneath administration. Koinly assists in creating crypto tax stories for each nation, including the US. Whether you’re using interest-bearing crypto merchandise poolside or mining cryptocurrency within the Alps, Koinly can produce an announcement that details all your crypto revenue. Crypto tax software is a program that helps you prepare taxes for your earnings on crypto assets. It permits you to calculate your profit and loss from cryptocurrency trading, in addition to capital gains and losses and expense deductions. It’s crucial to check what exchanges and wallets are supported before continuing.

What Occurs If You Make A Loss On Crypto Assets?

This is especially the case if you’re investing in a coin at a quantity of purchase prices. Once your transaction history has been analyzed, the software program can suggest probably the most suitable sales based in your circumstances. TokenTax covers the most well-liked exchanges, including centralized and DeFi platforms. It additionally supports lots of of wallets and is appropriate with both cryptocurrencies and NFTs. We additionally like that TokenTax integrates with spinoff trading platforms.

Easily see what goes on on across all your wallets and exchanges so you could make the most effective selections always. Here’s how a lot tax you may be paying in your revenue from Bitcoin, Ethereum, and different cryptocurrencies. Let’s cap things off by answering some regularly asked crypto taxes uk questions on cryptocurrency taxes. The Same Day Rule and the Bed & Breakfasting Rule exist to eliminate the potential tax advantages of wash gross sales. We can use the equation from above to calculate Emma’s capital gain from the sale of her 1 ETH in October. In the United Kingdom, inheritance tax applies if the entire worth of the estate exceeds £325,000.

Personal Tax

With the shared pooled accounting methodology, you’re primarily taking a mean of the costs you might have incurred to accumulate your crypto. These averages can be utilized to calculate your price basis per coin. Each cryptocurrency has its personal shared pool for figuring out basis. Of course, it’s additionally necessary https://www.xcritical.com/ to keep in mind that your cryptocurrency earnings from mining is classed in a different way whether or not you might be mining as a hobby or as a enterprise. It may be useful to maintain this quantity in thoughts when taking earnings on cryptocurrency.

Importantly, the software program can counsel the best method for minimizing your tax burden. However, don’t neglect about different asset courses you’re invested in, similar to shares or index funds. We’ve discovered and reviewed the best software to help you along with your crypto tax calculations and returns, so you don’t should. When filling out your Self Assessment, you’ll must report all your revenue and income.

Users report that that is usually accomplished in under 30 minutes. Once you’ve written down which crypto transactions you want to pay Capital Gains Tax on, it’s time to work out the revenue. You just have to import your transaction history and we are going to help you categorize your transactions and calculate realized profit and earnings.

- Our crypto tax software program comparability exhibits that Koinly is the general best choice.

- Crypto tax software doesn’t at present integrate directly with HMRC, but one of the best platforms will assist you to routinely fill in your tax types.

- The UK is one of Europe’s largest crypto hubs, with $170 billion in crypto offers now in place.

- Data could also be imported from greater than four hundred crypto exchanges and more than one hundred crypto wallets, and your transaction information is routinely synchronized.

- This file can then be imported into your chosen crypto tax software program.

- This may be extremely time consuming to do by hand, since most trade information wouldn’t have a reference price point, and records between exchanges usually are not easily appropriate.

You won’t be required to report your crypto to the HMRC except you earn or eliminate your holdings. It’s doubtless that different exchanges operating in the United Kingdom share buyer information with tax authorities upon request. Jordan Bass is the Head of Tax Strategy at CoinLedger, an authorized public accountant, and a tax legal professional specializing in digital belongings. In this information, we’ll cover everything you have to know about HM Revenue and Customs (HMRC’s) guidance on cryptocurrency taxes. The UK tax year runs from the sixth April to 5th April and the deadline for reporting and paying taxes is thirty first January of the next 12 months. If you own crypto that has lost all worth, you might submit a claim for “negligible worth.” Because of this, you might fake that you just sold the asset even when you still personal it.