They do not undertake leverage or borrowing other than to meet the permitted day to day operational requirements, as is specified for Category I AIFs. Authority for the issue and details of resolution passed for the issue. Equity ratios before and after the issue is made shall be incorporated. Of the term loans including re-schedulement, prepayment, penalty, default, etc. Allowance to be made for persons other than the members of the issuer.

The Millennial generation has a better awareness of the global environment and has better financial intelligence than the generations of their generation who raised them. But you have to find out some basics before you invest, such as the domain where the investment is being made. Draft offer document with the Board or proposed to be acquired by it. Directors or key management personnel of the issuer or the group companies.

It is a great way for companies to market to a whole new audience in the open market industry. This certificate demonstrates that IIFL as an organization has defined and put in place best-practice information security processes. Category II AIF are those AIFs for which no specific incentives or concessions are given.

- Central and state governments issue debt securities to meet their requirements for short and long term funds to meet their deficits.

- In case of a further public offer , the issuer may make reservation on competitive basis out of the issue size excluding promoters’ contribution and net offer to public in favour of retail individual shareholders of the issuer.

- Any bidder from a country that shares a land border with India will be eligible to bid.

- IFMC Institute is governed by representatives who act as an IFMCians.

- Submission of offer document to SEBI should not in any way be deemed or construed that the same has been cleared or approved by SEBI.

Initial Public Offering can be defined as the process in which a private company or corporation can become public by selling a portion of its stake to the investors. As closed-end funds these schemes are listed on stock exchanges where they may be traded at prices related to the NAV. Thematic funds invest in stocks of companies which may be defined by a unifying underlying theme. For example, infrastructure funds invest in stocks in the infrastructure sector, across construction, cement, banking and logistics. They are more diversified than sector funds but more concentrated than a diversified equity fund. Sector funds invest in companies that belong to a particular sector such as technology or banking.

There shall be a lock-in of 30 days on the shares allotted to the Anchor Investors from the date of allotment in the public issue. Abridged Prospectus the memorandum as prescribed in Form 2A under sub-section of section 56 of the Companies Act, 1956. Outstanding litigations and material developments, litigations involving the company and its subsidiaries, promoters and group companies are disclosed.

The successful bidder, if a single company, can also execute the project through a special purpose vehicle with at least 76% shareholding in the SPV registered under the Indian Companies Act, 2013, before signing the PPA. Investments are subject to a three-year lock-in on the investments made to get the tax benefit. The primary risk in FMPs is credit risk from a possible default by the issuer. The bond price is the present value of cash inflows from the bond, discounted by the market yield. All grades obtained for the IPO along with a description of the grades can be found in the Prospectus.

Why does a company make an FPO?

The only way a company raise equity capital via an IPO is through a very detailed analysis. If the IPO is approved it should lead to an excellent potential for growth, and many public investors are expected to start looking to buy shares as part of their investment strategy. IPOs are typically discounted as if to ensure sales, making their attractiveness even higher.

This requires approval from the securities and exchange commission. The BSE has for example a listing division aimed at granting approval on stocks. The BSE lists the following standards required to get listed meaning of green shoe option on its stock exchanges. Only companies that meet these requirements receive approval by the BSE. A privately held company is converted to a publicly-traded business by supplying its shares publicly.

What is an example of a green shoe option?

For example, if a company decides to sell 1 million shares publicly, the underwriters can exercise their greenshoe option and sell 1.15 million shares. When the shares are priced and can be publicly traded, the underwriters can buy back 15% of the shares.

It also provides smart investors with the chance to earn handsome profits from investments. If you are investing in IPOs, you should make sure to invest wisely. Before joining the bandwagon, one must be clear on what the basics are. AGreenshoe optionallows the group of investment banks that underwrite an initial public offering to buy and offer for sale 15% more shares at the same offering price than the issuing company originally planned to sell. Of the issued capital , which inter-alia shall include name, designation and quantum of the equity shares issued under an employee stock option scheme or employee stock purchase scheme and the quantum they intend to sell within three months. An overallotment is an option commonly available to underwriters that allows the sale of additional shares that a company plans to issue in an initial public offering or secondary/follow-on offering.

IPOs: From what is greenshoe option to how it helps investors, take a short take a look at crucial points

Abridged Prospectus, issue advertisement or any other place where the issuer company is making advertisement for its issue. Further the Grading letter of the Credit Rating Agency which contains the detailed rationale for assigning the particular grade will be included among the Material Documents available for Inspection. The company desirous of making the IPO is required to bear the expenses incurred for grading such IPO. In the case of reserved categories, a single applicant in the reserved category may make an application for a number of specified securities which exceeds the reservation.

Why is green shoe option important?

The Green-shoe Option, also referred to as the overallotment option, allows the underwriters to sell more shares than the initially agreed number within 30 days of issuing the IPO. So, if the stock price rises, underwriters buy extra stock from the company—up to 15%— and sell it to the public at a profit.

An overallotment option allows underwriters to issue as many as 15% more shares than originally planned. Public issue of shares is a very common way of raising funds by a corporate entity. However many a times it has been seen that after public issue of shares the listed price of securities falls below issue price which creates panic in the market and discourages the investors to put their hard earned money in IPO market. If a company convinces investors to buy certain shares, it invests a lot of profit for future. IPO’s is often issued by smaller, young companies seeking capital for their expansion. In this, one gets profit as when a person initially invests they give a minimum purchase price which later gets increased.

Bankers to the issue

Allotments shall be given from the date of incorporation of the issuer. The period for which the issuer proposes to avail of the stabilisation mechanism. In case of partial underwriting of the issue, the extent of underwriting. The appointment is pursuant to regulation 16 of these regulations. The above possibility is primarily used at the time of IPO or itemizing of any inventory to make sure a successful opening price. Any Grievances related the aforesaid brokerage scheme will not be entertained on exchange platform.

Increasing transparency and share list credibility could also help in obtaining better terms on borrowing. If a company decides to sell 1 million shares publicly, the underwriters can exercise theirgreenshoe optionand sell 1.15 million shares. When the shares are priced and can be publicly traded, the underwriters can buy back 15% of the shares. Now that you are aware of what is IPO in stock markets, here’s a look at the process of an IPO and the steps well-informed investors must take, before investing their hard-earned money in IPOs. To know the IPO definition, you have to understand its process. Before announcing an IPO, a company approaches an investment bank to manage the IPO’s process.

Fixed Price Issues

To start with, a company should look for investment underwriters. In this case an investment bank’s role is assisting the company in the identification of various information. For a prudent investor, merely knowing IPO definition won’t suffice. You must have a clear understanding of the company’s vital financial benchmarks before investing in Upcoming IPOs.

Accordingly, companies can intervene available in the market to stabilise share costs through the first 30 days’ time window immediately after itemizing. This includes purchase of fairness shares from the market by the underwriting syndicate in case the share value fall under concern value or goes considerably above the difficulty value. A block construct that is accelerated is incessantly implemented in a single day, with the issuing firm contacting numerous funding banks that may function underwriters on the evening previous to the meant placement. The issuer solicits bids in an auction-type course of and awards the underwriting contract to the bank that commits to the very best again cease worth.

IFMC enables stock market professionals to expand their knowledge, stay tuned with emerging knowledge, and upgrade skills to climb a career in stock market. We are committed to producing Stock Market Analyst, Technical Analyst, NSE, BSE, NCFM, and NISM certification, Equity Analyst, Research Analyst and other financial market professionals for this upcoming sector. IPO prospectus – this document provides information to the public regarding an IPO listing after it was approved by SEBI. Flipping is the practice of selling stocks on IPOs at their initial stages to make quick profit.

This allows issuer companies to sell additional shares on secondary market when oversupply is suspected. In general, investors decide what kind of IPO a business wants. Although an existing investor might have expertise, this may be intimidating for a newer investor. The investor is able to decide by examining the IPO prospectuses of the companies. The prospectus assists the investor with establishing a clear idea of the company’s business plan in order to raising stocks in the market. Once decisions have taken place, investors should look for the next steps.

In the entire process the company has no role to play and any gains or losses arising out of the green shoe option belongs to the underwriters. Borrowing from the market often becomes an obvious choice for a growing company that has already used up a lot of private capital for its expansion. To borrow money from the public, a company must list itself in the stock market.

SEBI ICDR Regulations 2009 permit only retail individual investors to have an option of applying at cut off price. The offer document may have a floor price for the securities or a price band within which the investors can bid. The spread between the floor and the cap of the price band can not be more than 20%. In other words, it means that the cap should not be more than 120% of the floor price.

The risk is that the company may fall into bad times and default on the payment of interest or return of principal. A retail investor is not required to make his bid at a specific price. Since he is not able to take a call on the right price, he should use the cut-off option. This would ensure that his application will be considered valid at all prices, including the final price decided by the issuer. For making bids at cut-off price, the payment has to be made at the highest price of the price band. In case a lower price is finalized or in case the investor is an unsuccessful allottee or is allotted lesser shares than applied for, he would get the necessary refund.

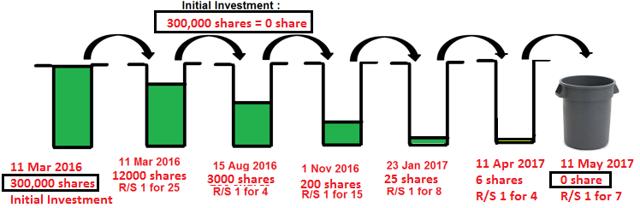

The 2008 monetary disaster resulted in a yr with the least variety of IPOs. The specified securities borrowed shall be in dematerialised form and allocation of these securities shall be made pro-rata to all successful applicants. Say listing date is 1st March and hence golden shoe option will be available till 30th March (i.e maximum 30 days from date of listing).

Why is green shoe option important?

The Green-shoe Option, also referred to as the overallotment option, allows the underwriters to sell more shares than the initially agreed number within 30 days of issuing the IPO. So, if the stock price rises, underwriters buy extra stock from the company—up to 15%— and sell it to the public at a profit.