PHOENIX Higher domestic conversion process cost and you will home loan rates is squeeze aside first-big date home buyers out of entering the field, especially as the revenue have not left upwards, casing experts say.

Inside the 2020, brand new housing industry was a student in a madness. Higher numbers of homes was in fact promoting, agents’ stocks was indeed lowest and provides was basically apparently getting made-over checklist costs, said Jason Giarrizzo, an agent which have Western U . s . Realty, who has been on the market having 29 age.

Appearing out of 2020, into the COVID-19 pandemic, the marketplace continued so you can rise as the anyone first started to shop for real estate, Giarrizzo told you. I were not yes where in actuality the field was going to wade, (if) it (was) likely to plummet because of you know, the fresh shutdown and you may what you, nevertheless try to the contrary.

A well-balanced sector from the Phoenix urban urban area would have list degrees of about 31,000 functions, Giarrizzo said, however, by the end away from 2021 collection started to shrink in order to throughout the cuatro,400 attributes in your community.

Following, home prices strike a premier and rates started initially to ascend due to the fact Government Reserve become increasing prices so that you can head regarding inflation. In every my several years of real estate, I don’t consider We spotted the newest collection spike to the level it did in such a brief period of your time. I went of 4,eight hundred qualities merely being received by spring season to help you almost 20,000 features available by the june, Giarrizzo told you.

Now, brand new list is at from the 13,000, which is still half of just what a balanced index is actually for the fresh Phoenix metropolitan town, Giarrizzo said.

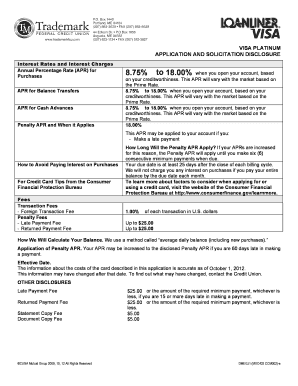

Mortgage loan interest rates differ extensively according to products like the individual markets, credit history of your visitors, price of the house, advance payment, speed types of, loan name and kind.

The current average rate to own a conventional 29-12 months fixed financial was at or below 8.063% to possess an excellent $430,000 household within the Washington having a buyer which have a credit history of 700-719 just who puts 10% off, with respect to the Consumer Monetary Coverage Bureau.

Chris Giarrizzo, an interest rate manager at Lennar Financial, who has been in the business for over 23 age and you may is actually partnered to help you Jason Giarrizzo, said of many every hour employees are not able to manage property, whether it is property purchase, otherwise book.

The newest median household income rate from the Phoenix metropolitan area when you look at the are $435,700, based on Redfin, a genuine house company one songs pricing and you may manner.

I actually wouldn’t state always its a detrimental for you personally to pick a property, it is simply a challenging time and energy to pick property, Chris Giarrizzo said.

Highest home prices and interest levels donate to hard marketplace for first-day homeowners

Even when home mortgage rates was basically this high prior to, highest conversion costs are delivering slight relief to people, she said, as there are no save expected up until perhaps some time next year.

It had been a combination of individuals who gone to live in the official and those who got significantly more throwaway money after the pandemic shutdown one to drove the new , Chris Giarrizzo told you.

I weren’t out searching and you will weren’t travelling, and therefore I am going to be honest, not just in my personal business, in numerous marketplaces, somebody got mentioned that that they had never been as busy. … We had been all-working enough instances, Chris Giarrizzo told you.

An effective prime violent storm out of sought after, low interest and not adequate directory drove home values upwards, starting the brand new frenzy of people spending more listing rate because there was so much competition, she told you.

First-go out homebuyers in the business

You may have we that will be only sitting on the new sidelines immediately, wanting to plunge for the and purchase its very first family, Chris Giarrizzo said.