Once you know the salvage value, you may https://www.bookstime.com/ go ahead to calculate depreciation. She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies.

How To Determine an Asset’s Salvage Value

Additionally, consider the example of a business owner whose desk has a useful life of seven years. How much the desk is worth at the end of seven years (its fair market value as determined by agreement or appraisal) is its residual value, also known as salvage value. This information is helpful to management to know how much cash flow it may receive if it were to sell the desk at the end of its useful life. If you lease a car for three years, its residual value is how much it is worth after three years. The residual value is determined by the bank that issues the lease, and it is based on past models and future predictions.

- This $1,000 may also be considered the salvage value, though scrap value is slightly more descriptive of how the company may dispose of the asset.

- The following tables are for use in figuring depreciation deductions under the ACRS system.

- Companies may use software tools like Sage Fixed Assets or Asset Panda to aid in calculating salvage value.

- There are tables for 18- and 19-year real property later in this publication in the Appendix.

- So, total depreciation of $45,000 spread across 15 years of useful life gives annual depreciation of $3,000 per year.

- However, nonrecognition rules can allow you to postpone some gain.

Table of Contents

On March 19, 1986, you bought and placed in service a $13,000 light-duty Accounting Periods and Methods panel truck to be used in your business and a $500 electric saw. You decided to recover the cost of the truck, which is 3-year recovery property, over 5 years. The saw is 5-year property, but you decided to recover its cost over 12 years. You find the month in your tax year that you placed the property in service.

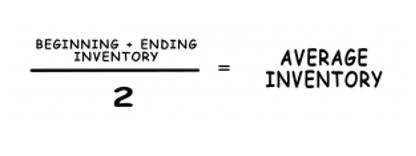

2 Determining the useful life and salvage value of an asset

Owing to these factors, the companies need to make the asset cost-efficient. Besides, the salvage value companies also need to ensure that the goods generated are economical from the customer’s perspective as well. Overall, the companies have to calculate the efficiency of the machine to maintain relevance in the market.

Debt Refinancing: Principles, Types, and Financial Impacts

In some cases, this risk can be greater than that of traditional investments. Diversify your portfolio with private market investment offerings. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

- When doing accounting, put $0 whenever asked for a salvage value.

- It is the length of time over which you will make yearly depreciation deductions of your basis in the property.

- The useful life of the same type of property varies from user to user.

- The sum-of-the-years’ digits (SYD) method also allows for accelerated depreciation.

- Therefore, the DDB method would record depreciation expenses at (20% × 2) or 40% of the remaining depreciable amount per year.

- The straight-line method is the most basic way to record depreciation.

You cannot make the change on an amended return filed after the due date of the original return (including extensions). If you dispose of 15-year real property, you base your ACRS deduction for the year of disposition on the number of months in use. For a disposition at any time during a particular month before the end of the recovery period, no deduction is allowed for the month of disposition. This applies whether you use the regular ACRS method or elected the alternate ACRS method. Under ACRS, you could also elect to use the alternate ACRS method for 15-year real property. The alternate ACRS method allows you to depreciate your 15-year real property using the straight line ACRS method over the alternate recovery periods of 15, 35, or 45 years.

- Cash flow statements, while not directly altered by salvage value, are indirectly impacted through tax savings and the timing of cash outflows related to asset replacements.

- Information on all FINRA registered broker-dealers can be found on FINRA’s BrokerCheck.

- 19-year real property is real property that is recovery property placed in service after May 8, 1985, and before 1987.

- The amount an asset is depreciated in a given period of time is a representation of how much of that asset’s value has been used up.

- Additionally, investors may receive illiquid and/or restricted securities that may be subject to holding period requirements and/or liquidity concerns.

- That’s why it’s wiser to go for zero value while applying depreciation on the asset.

The sum-of-the-years’ digits (SYD) method also allows for accelerated depreciation. You start by combining all the digits of the expected life of the asset. Note that while salvage value is not used in declining balance calculations, once an asset has been depreciated down to its salvage value, it cannot be further depreciated. The following tables are for use in figuring depreciation deductions under the ACRS system.