A change in accounting estimate is not accounted for by restating or retrospectively adjusting amounts reported in previously issued financial statements or by reporting pro forma amounts for prior periods. Once an error is identified, the accounting and reporting conclusions will depend on the materiality of the error(s) to the financial statements. Additionally, when evaluating the materiality of an error in interim period financial statements, the estimated income for the full fiscal year and the effect on earnings trends should be considered. Earnings trends may include consecutive quarter, year to date and year over year comparisons. The correction of an error may also impact other trends, such as changing net income to a net loss (or vice versa) or causing a registrant to miss analyst expectations. If the adoption of a new accounting principle results in a material change in an asset or liability, the adjustment must be reported to the retained earnings’ opening balance.

Error Corrections

As previously reported financial information has changed, we believe clear and transparent disclosure about the nature and impact on the financial statements should be included within the financial statement footnotes. As the effect of the error corrections on the prior periods is by definition, immaterial, column headings are not required to be labeled. Moreover, the auditor’s opinion is generally not revised to include an explanatory paragraph in a Little r restatement scenario.

About GAAPology

Also, thanks to a recently adopted SEC rule, listed issuers will be required to have a written policy for recovery of incentive-based compensation received by the issuer’s current or former executive officers in the event of a restatement. Mind you, this applies to both “Big R” restatements and “Little r” revisions, basically implementing the previous mandate under Dodd-Frank requiring the SEC to adopt such policies. From leadership’s perspective, it’s probably best to think of this group as investors, regulators, lenders, or virtually any other reasonable person who has a valid use for a company’s financial statements. Further, keep in mind that when an entity makes reclassification and presentation changes, the best practice is to recast prior-period information to conform. Thankfully, the public can rely on consistent, reliable, comparable financial statements from organizations to sort it all out and maintain a clear, unobstructed view of operations.

Internal Controls Over Financial Reporting

- To illustrate the difference between the iron curtain and rollover methods, let’s look at a simple example that ignores income tax impact and focuses solely on errors in the income statement and balance sheet.

- Reclassifications represent changes from one acceptable presentation under GAAP to another acceptable presentation.

- PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network.

- Essentially, the Supreme Court held that a fact is material if “there is a substantial likelihood that the… fact would have been viewed by a reasonable investor as having significantly altered the ‘total mix’ of information made available.”

Accordingly, a change in an accounting policy from one that is not generally accepted by GAAP to one that is generally accepted by GAAP is considered an error correction, not a change in accounting principle. Likewise, if information is misinterpreted or old data is used when more current information is available in developing an estimate, an error exists, not a change in estimate. Moreover, as it relates to the classification and presentation of account balances on the face of the financial statements, “reclassifications” are often confused with errors. Changing the classification of an account balance from an incorrect presentation to the correct presentation is considered an error correction, not a reclassification (see Section 3 below for more on reclassifications). Big R restatements require the entity to restate previously issued prior period financial statements.

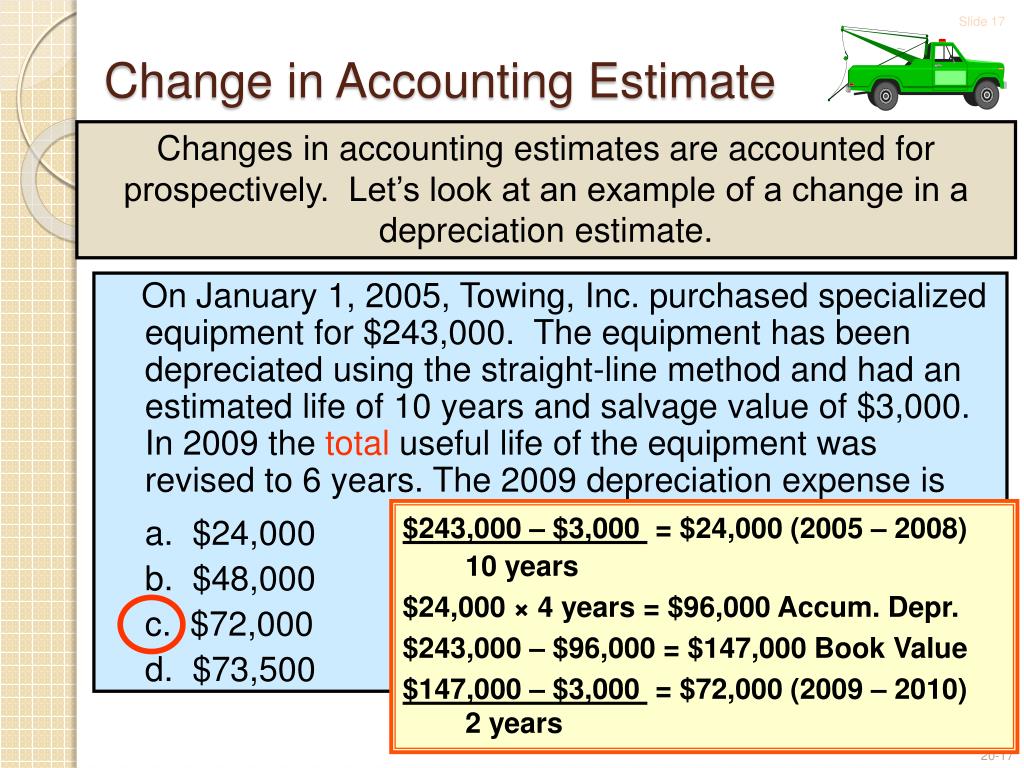

SFAS 154, Accounting Changes and Error Correction, documents how companies should treat changes in accounting principles and changes in accounting estimates, two related but different concepts. A principle determines how information should be reported, while an estimate is used to approximate information. The IASB’s goal of these amendments was to make it easier to differentiate between a change in accounting policy and a change in accounting estimate, and I think the amendments achieved this goal! These amendments are effective for annual reporting periods beginning on or after 1 January 2023. If the change is determined to be a change in accounting estimate, the change is accounted for prospectively.

Changes in the reporting entity mainly transpire from significant restructuring activities and transactions. Neither business combinations accounted for by the acquisition method nor the consolidation of a variable interest entity are considered changes in the reporting entity. There are cases where a retrospective application doesn’t have to be made, which includes having made all reasonable efforts to do so, which can include not being able to make subjective significant estimates or having to have knowledge of management’s intent. Other notable changes in accounting principles can include matching, going concern, or revenue recognition principles, among others.

Also, it’s important to remember that voluntary changes in accounting principle or changes in estimates that you can’t separate from the effect of a change in principle are only allowed if you can justify using an alternative as preferable. Mind you, our 805 example differs from a scenario where a business should have applied an accounting policy or principle but didn’t. That’s exactly why we’re taking a deep dive into ASC 250 today, discussing what to do when accounting changes and errors go bump in the reporting night. As you’ll see, while changes, restatements, and revisions might not be your favorite things to do, it doesn’t mean you should lose sleep over them, either. This publication summarizes the new accounting standards with mandatory effective dates in the first quarter of 2024 for public entities, as well as new standards that take effect in annual 2023 financial statements for nonpublic entities.

Such a memo includes evaluation of the error from both a quantitative and qualitative perspective, and will often conclude on how the company will correct the error, if at all, based on the evaluation. Yes, quantitative measurements of baselines can certainly help guide the ultimate determination. In other words, an error might be material due to its size alone, but in other instances, a quantitatively smaller error may be material because of its nature. Therefore, management should look through both a quantitative change in accounting principle inseparable from a change in estimate and qualitative lens for any assessment, but we’ll expand on that in the next section. While the interpretive guidance on materiality comes from an SEC staff interpretation – based on a Supreme Court precedent – it’s still widely used by all entities in practice. Essentially, the Supreme Court held that a fact is material if “there is a substantial likelihood that the… fact would have been viewed by a reasonable investor as having significantly altered the ‘total mix’ of information made available.”