Toward change to your the fresh new interest standard, individuals with a great SIBOR-centered home loan are advised to start investigating solution loan bundles

If for example the response is yes assuming the speed was labelled to the Singapore Interbank Given Price (SIBOR), today is the most useful time for you contact your lender and speak about the choices to own an option mortgage plan.

This is because SIBOR, that is used to assess attract payments, tend to vanish after that year, according to the around the globe shift to your benchmarks which use genuine deals in their data.

Of the looking into solution mortgage packages before avoid regarding April, you will find more time to select a mortgage bundle that suits your circumstances. There aren’t any fees for folks who replace of your SIBOR-created financial to almost any most other prevalent financial plan given by the financial.

Off SIBOR so you’re able to SORA

New phasing out-of SIBOR, mortgage produced by quotes provided by banking companies who may have become employed for in the event that Direction Panel getting SOR & SIBOR Change to help you SORA (SC-STS)is the reason mandate are expanded so you can manage the industry-wider move from the Singapore Dollars Exchange Bring Price (SOR) and you will SIBOR on the yet another interest rate standard.

SORA, and this is the Singapore Right-away Rates Average, is the key interest rate standard one to Singapore financial institutions now play with to help you speed really floating-rate loans. Its determined using the cost financial institutions shell out one another to borrow funds and that’s came back the next day. Singapore banks stopped giving the new SIBOR-established casing money into the , and therefore are already providing home owners changeover off their established SIBOR-centered fund in order to a choice mortgage package of its choice.

To be certain a smooth changeover, homeowners having current SIBOR-founded loans should take time to reach on the banks and speak about alternative mortgage packages before prevent out-of April, or keeps the money immediately transformed into the brand new SORA Conversion process Package out of June 1. The brand new SORA Conversion Bundle utilized by Singapore financial institutions was created to minimise alterations in home loan borrowers’ most of the-during the mortgage fee on area off transformation of your own loan.

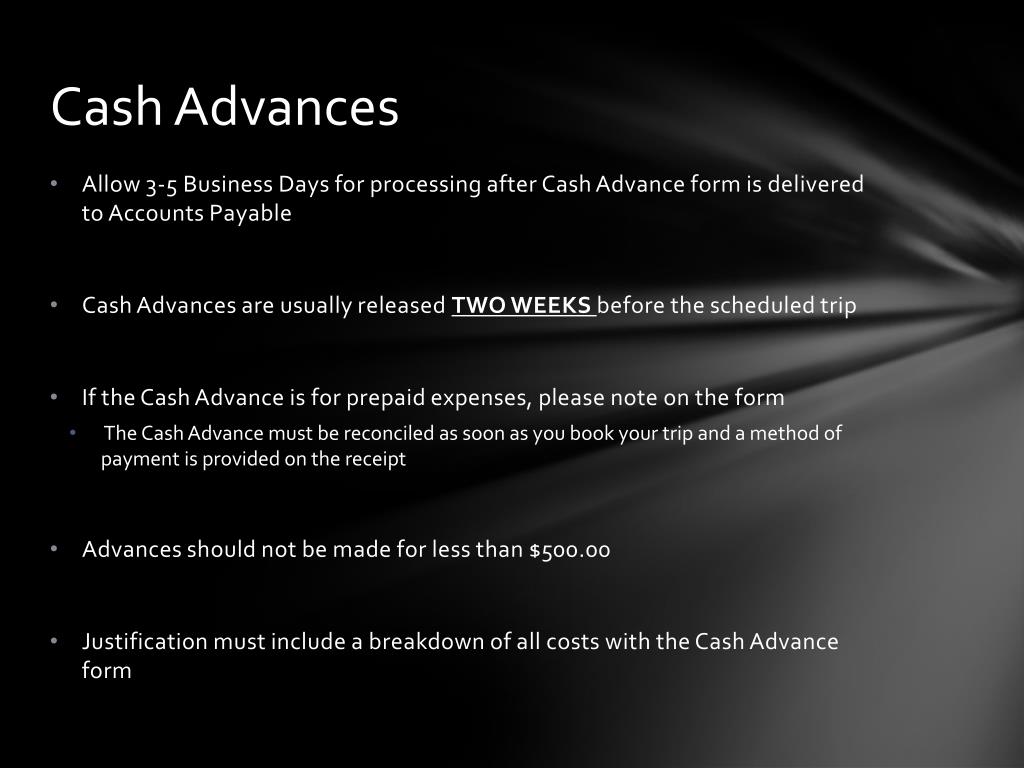

Changes to your bank’s prevalent financing packages or the SORA Conversion process Package might possibly be commission-free, if you do not need to refinance with an alternate lender in which particular case, charge may incorporate.

Home owners whoever mortgage bundles is actually instantly converted to brand new SORA Sales Bundle remain entitled to a charge-free change to some of their bank’s prevailing bundles prior to .

This new financing limits wouldn’t apply

Mrs Ong-Ang Ai Benefit, director of your own Association regarding Financial institutions inside Singapore (ABS), believes that it is good for home owners become proactive within the securing an alternative mortgage during this change.

A mortgage could be an individual’s biggest financial obligation, which it is important for individuals so you’re able to proactively do it, regardless of interest rate movements.

Toward change deadline quickly approaching, borrowers are strongly motivated to get in touch with the banks’ mortgage specialist eventually in the place of after, to acquire suggestions about alternatives which may best suit its earnings and choice, she states.

People having established SIBOR-mainly based finance shouldn’t have to care about adhering to the new stronger lending conditions brought in recent years whenever they prefer a replacement financing from the exact same standard bank.

Abs says the latest Financial Expert out-of Singapore (MAS) cannot want banks so you’re able to re-calculate the borrowed funds-to-well worth proportion (LTV), mortgage servicing proportion (MSR) and total loans servicing ratio (TDSR) just like the need certainly to alter the SIBOR-established assets loan having an alternative mortgage plan are necessitated because of the new discontinuation away from SIBOR with the .

Work prompt

When you’re over fifty percent of people with SIBOR-oriented funds have transitioned away just like the , there were still specific 54,000 property owners once the in the avoid- that but really to alter their current SIBOR-dependent finance.

Residents is act rapidly and you will approach the banking institutions long before new end-April deadline, to create on their own longer to choose an solution mortgage package, claims Mrs Ong.

Trick deadlines you should pay attention https://elitecashadvance.com/installment-loans-mi/nashville/ to:

: Past date to own SIBOR-established home loans getting transformed into the latest bank’s prevalent fixed-price, floating-price or hybrid financing packages. Residents may opt to convert to the new SORA Conversion Plan.

Before : For those who change your brain in regards to the SORA Conversion Bundle, it’s also possible to get hold of your bank accomplish a free, one-date switch to yet another home loan.