Instead of drowning in spreadsheets, the organization can focus on its core mission. Accurate bookkeeping plays a vital role in ensuring transparency, compliance, and effective financial management. This guide will show how precise bookkeeping practices can empower nonprofits to fulfill their missions and make a meaningful difference in their communities. As such, they rely heavily on donations, grants, and other forms of fundraising to support their programs and initiatives. This reliance on external funding sources necessitates careful financial management to ensure sustainability and accountability. Learning how to handle nonprofit and accounting responsibilities and the required statements is essential for anyone who wants to run a nonprofit.

Importance of Fund Accounting

These components help ensure the organization’s financial health and transparency. Typically, a bookkeeper for a nonprofit organization works in coordination with a managing or executive director. They are responsible for performing a variety of nonprofit bookkeeping duties, including financial record keeping and transactions, such as accounts payable, accounts receivable, and general ledger.

What are some of the best practices of nonprofit accounting?

- Since nonprofit organizations don’t center on profit but on a nonprofit mission, they have different bookkeeping practices.

- As mentioned, nonprofits have to follow strict rules to justify their financial position and fundraising expenses.

- This includes hiring a college consultant who can help prepare them for standardized tests, review personal statements and navigate the world of financial aid and scholarships.

- The American Institute of Professional Bookkeepers offers certification for experienced bookkeepers.

- Ensuring accurate data entry and transparency in financial reporting builds trust with stakeholders and furthers the organization’s mission.

- Board members should possess financial literacy, understand the organization’s financial statements, and actively participate in financial discussions and decision-making.

While business stakeholders are concerned with profits, nonprofit stakeholders and board members want to know if the resources are properly utilized and allocated. For-profit entities are individuals, corporations, or partnerships that conduct business for profit. In this case, shareholders, investors, tax authorities, management, and suppliers are interested in the entity’s financial position, and that’s what for-profit accounting focuses on. The firm also announced a $1.1 million partnership with Women’s Health Access Matters, which funds women’s health research.

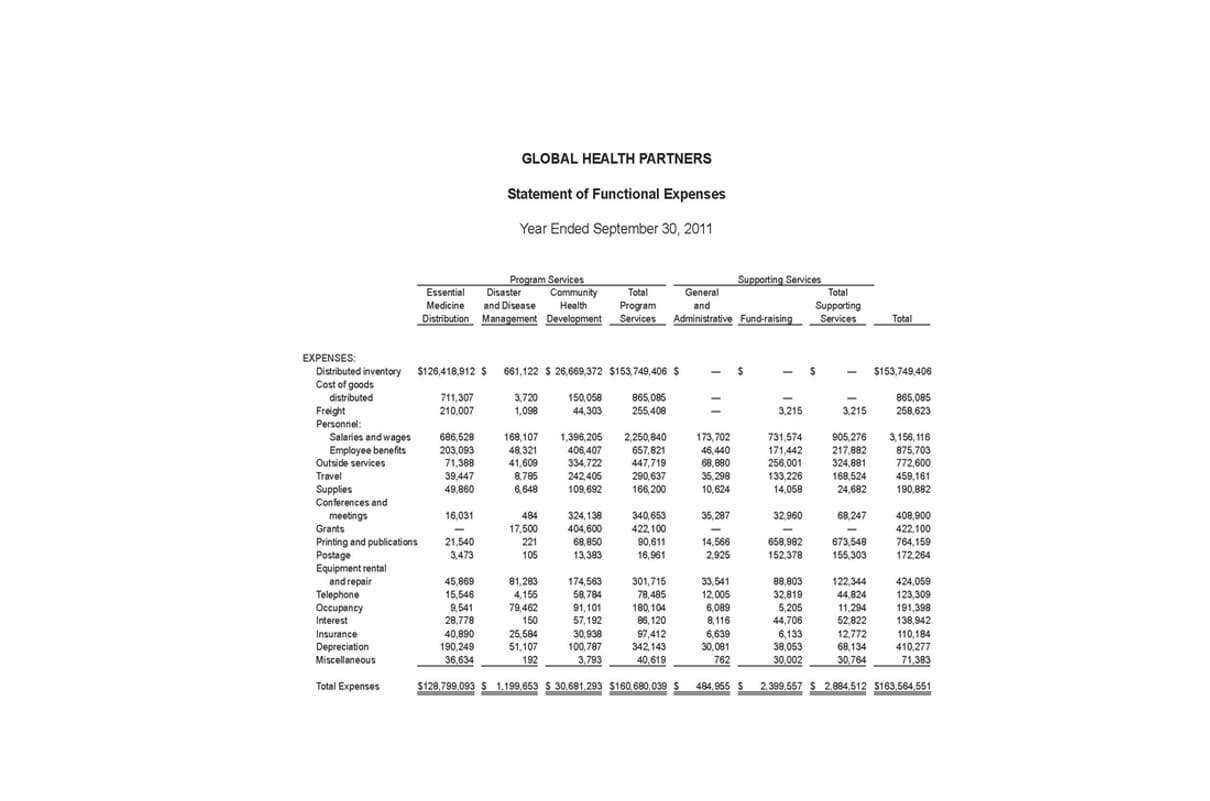

Statement of functional expenses

- These restrictions may limit how funds can be used and require separate tracking to ensure compliance.

- But the experience, responsibilities, and deliverables required of bookkeepers are very different from those required of accountants.

- When managing payroll for a nonprofit, bookkeepers must administer federal and state taxes, deduct money for employee benefits, and determine how funds are affected.

- Open communication regarding financial information builds trust among donors, beneficiaries, and the public.

- It is important that you know how much money you have, how much money you have spent, and how much money is going to be coming in.

The COA organizes all the accounts that a non profit uses to track its financial transactions, ensuring that each entry is categorized correctly. These financial statements can provide helpful insight into your nonprofit’s accounting services for nonprofit organizations financial health so that you can adjust accordingly and plan your next moves. Think of bookkeeping as studying for a test—it’s the necessary first step you must take to prepare yourself for the big exam.

As a nonprofit professional she has specialized in fundraising, marketing, event planning, volunteer management, and board development. Once a year, you’ll send the required documents to an accountant to submit Form 990 to the IRS and provide tax documentation to staff. You will also need an accountant to audit your financial statements and help work with you on future financial plans. You can determine whether these are one-time or regular experiences and choose how to raise funds for different programs that don’t gain as much financial support. A budget and strategic plan will help plan for better use of these funds and others.

- This up-skill discourages financial mishaps while promoting feasible efforts towards accomplishing goals.

- Partner with a qualified accountant or bookkeeper knowledgeable about nonprofit accounting and tax regulations.

- Bookkeepers must record these funds in a chart of accounts to better keep track.

- It emphasizes fund management, budget planning, program costing, and allocation of funds, in order to ensure financial transparency and accountability.

- FreshBooks is available on both computers and mobile devices, so you can stay on top of your nonprofit organization at any time.

In contrast, traditional businesses typically have fewer restrictions on the use of funds, allowing greater flexibility in financial management. They also implement an accurate bookkeeping system that shows the nonprofit organization’s financial transparency. By following these best practices, nonprofit organizations can maintain accurate financial records, ensure transparency, and build trust with their stakeholders.

Intuit QuickBooks offers several plans, ranging from $30 to $200 per month ($15 to $100 per month for the first three months during the current promotion). Plan differences revolve around the number of users, customization options, inventory management, automations and expense tracking. You have to pay an extra fee for payroll services, starting at $45 per month. Xero’s highly customizable and in-depth reporting tools make Xero stand out.

Fund accounting allows nonprofits to bucket money into different categories to keep them organized and ensure the funds go to the designated requests. Since donors can restrict how funds are spent, nonprofits use a different method of bookkeeping that fits their business model. We’re honored that over 120 nonprofits trust us with their bookkeeping and accounting. And we’d be excited to show you how we can help your organization meet your goals.

Consider Church Accounting Software to Simplify Your Spreadsheets

As a private accountant, you’ll typically work for one company, rather than a government, nonprofit, or mix of individuals and corporations. In most cases, the organization you work for will be a large company, and it may even be publicly traded. We found the best Excel workbook and PDF format accounting templates you can try for free to make your church budget management simpler and more streamlined.

Nonprofit Bookkeeping Software: An Overview

Some are unrestricted net assets and some are considered restricted net assets. Bank reconciliation is the process of ensuring an organization’s records (balance sheet, general ledger account, cash flow, etc.) are accurate. A nonprofit reconciles bank accounts by comparing the recorded amounts to the amounts on bank statements. Nonprofit accounting and bookkeeping revolve around representing an organization’s financial records in compliance with generally accepted accounting principles (GAAP). Auditing involves examining financial statements of organizations to ensure accuracy and compliance with laws and regulations or improvements to processes and internal controls.