W hen you are looking at attempting to sell your house within the Alberta, with an enthusiastic assumable home loan will be yet another selling point to help you focus potential buyers. Promoting property having an assumable financial lets the consumer so you can dominate the newest seller’s mortgage according to the same conditions, that will be for example enticing inside market in which rates is actually high otherwise increasing. Let us explore just how a keen assumable mortgage works, exactly what pros and cons to help you be the cause of, and just how suppliers is also leverage this particular aspect so you can probably expedite the household selling.

To possess informational objectives only. Usually speak with an authorized financial or mortgage professional in advance of proceeding which have any real estate exchange.

What is actually a keen Assumable Financial?

Just in case a preexisting mortgage lets a beneficial homebuyer to take along the newest owner’s mortgage terms and conditions. Fundamentally, the mortgage (and its particular rate of interest) is ended up selling along with the property. It’s an extremely certified style of financing that isn’t really commonly included in Canada, however it can also be do just fine regarding the proper factors.

According to newest customer’s collateral yourself, the brand new down-payment made by the customer may vary. The consumer accounts for paying the difference in the brand new the financial as well as the home’s worth.

Such as, in the event your price was $800,000 additionally the home possess a left home loan harmony from $500,000, the buyer must pay $three hundred,000 with the provider initial (otherwise workout a payment bundle on the supplier). This might be a much larger number compared to the typical 20% advance payment of $160,000 into a keen $800,000 home, and could require customer to take out an additional home loan. While doing so, in case the supplier features hardly any equity home, instance whenever offering property following to acquire, the buyer may be able to purchase a house with much straight down away-of-pocket expenses.

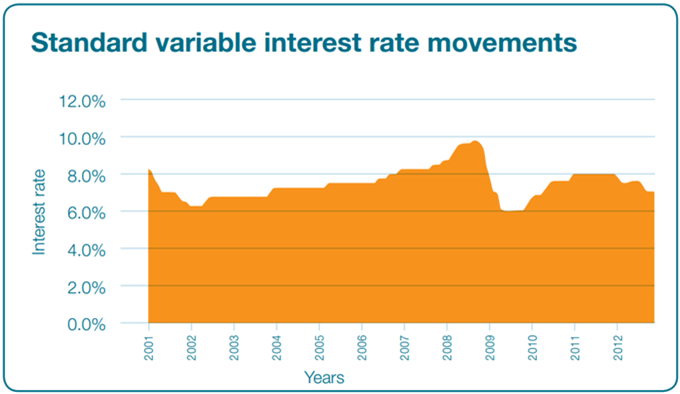

By if in case the borrowed funds, the consumer is skip the dilemma and you will charge away from trying to get a different mortgage and as an alternative step to the boots of your own past owner concerning your loan. This is like beneficial in the event that existing interest rate is lower as compared to most recent mortgage interest rates, potentially protecting individuals money in the long run.

Providers, concurrently, might find assumable mortgage loans of good use as possible made use of given that a feature when your interest levels are extremely advantageous, notice a new pool away from potential customers, and steer clear of prepayment punishment on financial.

And that Mortgage loans Is Assumable?

Basically, an enthusiastic assumable mortgage was one financial that the bank allows another borrower to take over. In the event that a home loan company actually happy to allow the mortgage become presumed, they have a condition on the financial contract saying therefore. Fundamentally, expectation clauses during the home loan contracts establish possibly that the financial you should never feel thought without the the latest buyer qualifying on the loan, or that the financial need to be paid upon the brand new product sales of the property (and therefore can’t be assumed).

As a whole, at the mercy of financial approval, extremely fixed-price mortgage loans in the Canada will be assumed, when you find yourself adjustable-speed mortgages and you can household guarantee finance cannot.

While you are selecting selling your house having an assumable mortgage, start by asking regarding option along with your bank.

Benefits & Cons out of Offering Having an Assumable Mortgages

With regards to promoting that have an assumable financial in the Canada, you should consider the huge benefits and cons very carefully during the context of your own newest market as well as your financial predicament.

Advantages

Manufacturers make use of drawing a different sort of pond out-of potential buyers which have assumable mortgages due to the attractiveness of reduced-rate funds. By offering an enthusiastic assumable mortgage, sellers makes their residence more appealing in order to people looking to make the most of favorable rates. This leads to a faster profit and potentially a high price point. At the same time, sellers is prevent financial prepayment penalties by permitting people to visualize the mortgage.

Customers, at exactly the same time, will benefit away from whenever a home loan when newest interest rates is actually greater than the first loan’s speed, giving them http://paydayloanalabama.com/butler/ tall coupons along the life of the loan. Capable and end spending charges connected with performing a new mortgage.

Disadvantages

That significant prospective downside having going for a keen assumable home loan whenever attempting to sell a property inside the Canada is that sellers can be made liable if for example the the fresh new borrower non-payments to your assumed home loan. Mortgages try a house lien; whether your buyer was economically reckless as well as the home cannot afterwards sell for enough to defense the loan, the financial institution normally legally need you to afford the improvement once the the original debtor. While you are concerned about this opportunity, pursue a launch request from your own bank which can release you from possible liability.

Buyers trying to find incase current financing might stumble on demands including since the needing a substantial deposit otherwise an extra home loan.

When you find yourself suppliers you will end prepayment punishment by permitting presumption, they might still be vulnerable to monetary consequences in the event the the fresh debtor problems the home or does not build money. Consider these issues cautiously before making a decision toward an enthusiastic assumable financial to own offering your property.

Selling your property when you look at the Canada with a keen assumable financial will be a great selection for both vendors and consumers about proper circumstances, saving money and you may streamlining new closure process.

But not, it’s important to carefully look at the terms of this new assumable financial and make certain the events are very well-informed. Trying recommendations of real estate professionals might help result in the exchange smoother plus efficient.

Getting informational motives only. Constantly consult an authorized home loan or financial elite ahead of continuing having any a home transaction.