By Kelsey Heath

Brand new average price of land across the Us has grown easily for the past few years. Despite usually high interest levels, casing prices round the many locations remained long lasting, and you may prices are nevertheless high.

As of the termination of 2023, the fresh new median home pricing is over $430,000. When you’re pricing will still be high, the mortgage count consumers normally qualify for has changed significantly. So, what money are needed to afford an effective $500k house?

The clear answer transform considering market requirements and personal economic products. Generally, exactly how much earnings you prefer having a great $500k family utilizes the rate you get and exactly how far currency you add off as the a deposit.

But not, individuals may also have their credit rating and you will debt-to-income proportion analyzed, and therefore influences their borrowing strength. When you’re thinking whenever you afford good $500,000 domestic, this post is good doing publication before you can contact good bank.

Key factors Impacting Family Affordability

When purchasing a house, there are key factors affecting property affordability payday loans Clovis, CA online not in the cost. Of these taking that loan, their price is very important. Exactly what has the most impact on their financial predicament is actually the mortgage words it get and their month-to-month mortgage repayment.

The month-to-month mortgage repayment find how large from that loan your is qualify for. When rates of interest was high, customers qualify for a smaller financing because interest increases its monthly will cost you.

Financial Cost and Words

When searching for an effective $five-hundred,000 domestic, home loan pricing and you can financing terms features a large effect on affordability. Even though interest levels and 30-year loans are not many enjoyable topics, they amount when purchasing property. You need the lowest payment substitute for be eligible for an excellent large loan.

For many who set out 20% to the good $five-hundred,000 domestic, your loan would-be $400,000. When you get a beneficial 5% price, your own payment is around $2,150.

But cost transform all round the day. If the rates go up so you can 7%, you to percentage jumps in order to $2,660. That’s over $five-hundred much more a month for only a 2% price boost. More than 30 years, you to definitely dos% has pricing more than $100,000 a lot more from inside the desire. Your loan interest have an unbelievable effect on what kind out-of domestic you really can afford plus a lot of time-name monetary health.

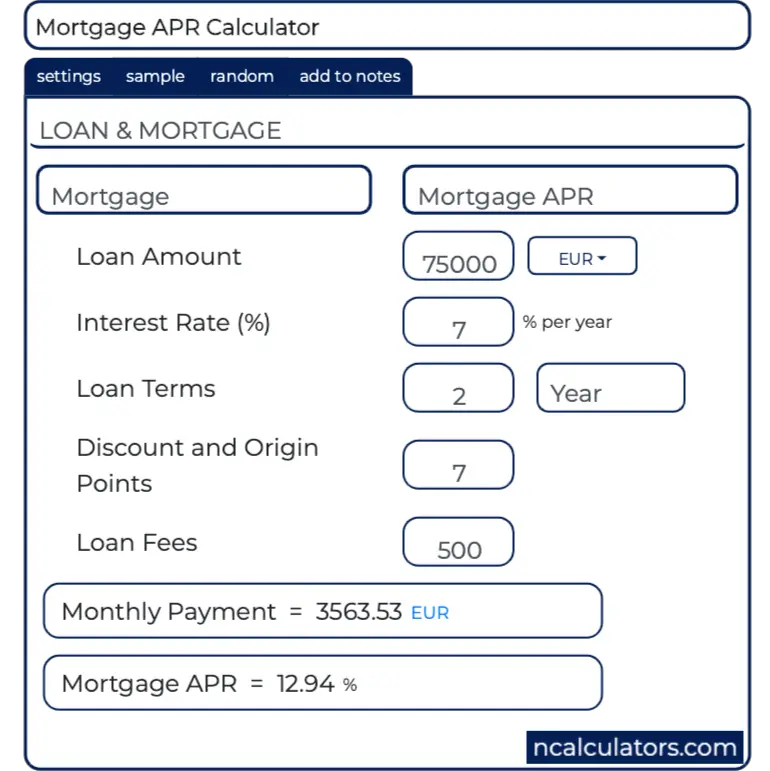

When comparing mortgage loans, their top desire ought to be the costs. Also short variations is also positively apply at your own monthly finances and you can long-title will cost you. To see exactly how rates feeling your unique disease, play with home financing calculator.

Plug on your own quantity and you can loan info and test more attract prices. The outcomes will most likely wonder both you and leave you important skills for getting an educated financial. When you find yourself advised, you can store wiser and you can rating the suitable package.

How big your own deposit enjoys an impression towards the amount you really need to acquire in addition to earnings expected to qualify for the borrowed funds. Particularly, if you are planning to shop for good $five-hundred,000 house, a much bigger downpayment form you merely have to be eligible for a smaller sized financial.

Having a $250,000 down-payment, you’ll only have to use $250,000. So it reduces the brand new monthly homeloan payment compared to resource ninety% of your $five hundred,000 purchase price. As a result, you can qualify for the mortgage having a reduced earnings than simply if you generated an inferior downpayment.

What exactly is a great deal more helpful would be the fact large off payments will correlate which have all the way down mortgage pricing (so it’s significantly more affordable). From the getting down extra money upfront, you may have increased stake regarding the assets. Ergo, lenders see you given that a lower chance since you have alot more security yourself. The low chance setting loan providers could offer a lesser speed.